**Helium’s HNT Buyback Program Fuels Price Growth Amid Rising On-Chain Metrics**

Helium’s buyback initiative harnesses network fees to repurchase HNT tokens, averaging $30,000 monthly and tightening supply. Increased activity on decentralized exchanges (DEX) has driven $3 million in weekly trading volume—the highest figure recorded—with buy orders outpacing sales. Meanwhile, price action forms an inverted head-and-shoulders pattern, holding strong above the $2 support level, signaling potential upside toward $4 if the $2.74 resistance breaks.

Discover how Helium’s HNT buyback program is empowering price growth amid solid on-chain fundamentals. Explore the latest analysis and what it means for investors looking ahead to 2025.

—

### What is the Helium HNT Buyback Program?

The Helium HNT buyback program is a strategic mechanism implemented by the Helium Network to utilize collected network fees to repurchase its native HNT tokens. This approach reduces the circulating supply and aims to support price stability.

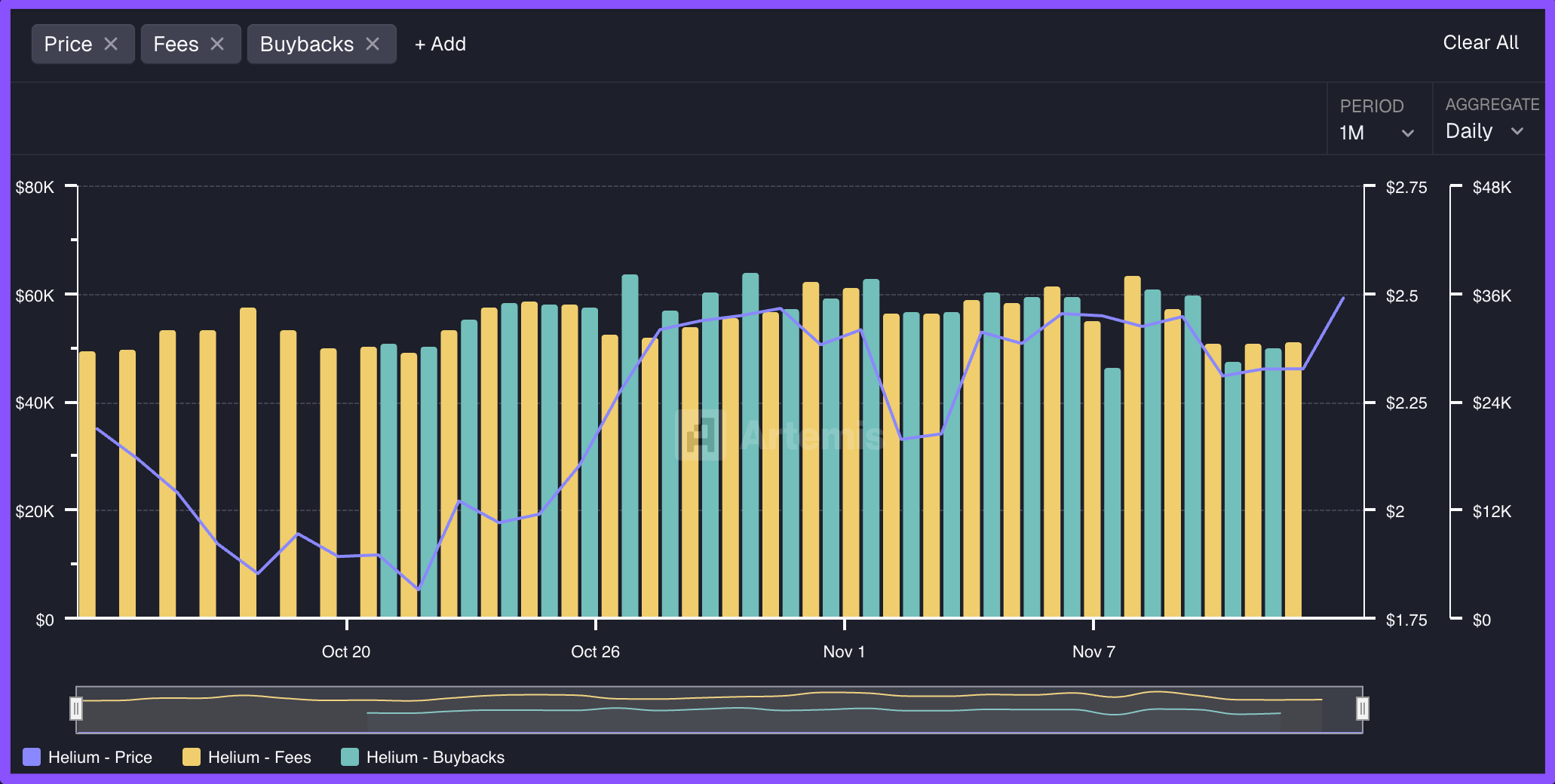

Launched on October 20, 2025, the program has enabled consistent token repurchases, averaging around $30,000 worth of HNT bought back each month over recent periods. As a decentralized physical infrastructure network operating on the Solana blockchain, Helium leverages this initiative to enhance long-term value for its token holders.

—

### How Has On-Chain Activity Influenced Helium’s Recent Performance?

Helium’s on-chain metrics have shown notable strength, especially in token transfers and DEX trading volumes. According to Solscan data:

– Total token transfers reached $30 million on a single day, reflecting robust network usage.

– DEX trading volume soared to $3 million—the peak weekly figure—with over 40,000 transfers following a parabolic growth trajectory since November 11, 2025.

– Buy-side activity totaled $1.47 million, surpassing sell-side orders at $1.32 million, underscoring growing demand.

These developments align with bullish signals from the buyback effort and are corroborated by network analytics platforms. Experts in blockchain infrastructure highlight that such increased activity often correlates with sustained price appreciation, especially when backed by strong fundamentals.

—

### Price Action and Technical Outlook

HNT experienced a brief dip recently but has maintained support above the $2 price level. Chart analysis reveals an inverted head-and-shoulders pattern forming, which suggests a potential bullish reversal if confirmed.

Key technical considerations include:

– Holding above $2 support is crucial.

– A breakout above the $2.74 resistance level could target a move up to $4.

– If resistance persists, consolidation may continue within the $2.17 to $2.74 range.

The Bull Bear Power indicator reflects a tight battle, with buyers currently holding a slight edge. Combined with the buyback program and rising DEX volumes, these technical signals paint an optimistic picture for HNT’s short to medium-term potential.

—

### Frequently Asked Questions

**What factors are currently driving the Helium HNT price?**

The HNT price is primarily driven by the buyback program funded through network fees, alongside surging DEX trading volumes and growing token transfer activity. These factors contributed to a 16% price increase over the past month, with daily trading volume reaching $17 million. Maintaining support above $2 could further bolster this upward trajectory.

**Can Helium HNT expect a price reversal in the near term?**

Yes. The formation of an inverted head-and-shoulders pattern indicates a potential bullish price reversal. If HNT holds above $2 support and breaks out past $2.74 resistance, the outlook could shift favorably toward $4. However, broader market conditions remain key to sustaining this momentum.

—

### Key Takeaways

– **Buyback Program Impact:** Helium’s fee-driven token repurchases average $30,000 monthly, shrinking supply and supporting price stability since its inception in October 2025.

– **On-Chain Surge:** DEX volumes have hit $3 million with buy orders surpassing sales, signaling strong network demand as per Solscan data.

– **Price Outlook:** An inverted head-and-shoulders formation suggests upside potential toward $4 if $2.74 resistance is breached, although market volatility poses risks.

—

### Conclusion

In summary, Helium’s HNT buyback program, combined with rising on-chain activity—including increased DEX volumes and token transfers—positions the network for promising growth throughout 2025. As a leading decentralized physical infrastructure network on Solana, Helium demonstrates resilience amid sector challenges.

Investors should closely monitor critical support levels and wider crypto market dynamics to make informed decisions. With fundamentals strengthening and daily trading volumes at $17 million, opportunities are emerging for the HNT token as it seeks to capitalize on its growing ecosystem.

—

### Additional Insights: HNT Fees vs. Buyback Program

Analyzing the Helium Network’s fee generation alongside token buybacks reveals a focused strategy on supply management. Since the program’s launch in October 2025, fees have funded consistent repurchases that initially propelled price gains before stabilizing in early November.

This consistent average of $30,000 monthly buybacks fosters a tighter circulating supply, potentially aligning with demand to support long-term value appreciation.

### Token Transfer and DEX Volume Surge

Helium’s token transfers and DEX volumes have risen sharply. Solscan data highlights total transfers hitting $30 million in a single day, showing strong network engagement.

DEX trading volume peaked at $3 million—the week’s highest—with more than 40,000 transfers following a steep, parabolic curve since November 11, 2025. During this period, buy-side activity exceeded sales ($1.47 million vs. $1.32 million), underlining dominant demand.

### Helium Price Action Analysis

Despite a brief price dip, HNT has maintained solid support above $2, trading within a developing inverted head-and-shoulders pattern that may serve as a base for upside movement.

The Bull Bear Power indicator reflects a close contest between buyers and sellers, with buyers currently holding a slight advantage. For a bullish breakout, HNT needs to close above $2.74 resistance, aiming for $4, or otherwise may continue consolidation between $2.17 and $2.74.

—

With increasing buybacks and surging DEX volumes, Helium continues to build momentum as a decentralized physical infrastructure network on Solana. Supported by daily volumes reaching $17 million and a 16% monthly price gain driven by these fundamentals, HNT remains a token to watch heading into 2025.

https://bitcoinethereumnews.com/tech/heliums-buyback-and-rising-dex-activity-signal-potential-hnt-price-reversal/