Category: finance

After Gold’s Record-Breaking Run Above $4,000, Silver Now Eyes Historic USD 50 Breakout; Could Outshine Gold In 2025 Rally

After gold hit USD 4,000, silver is nearing its all-time high of USD 49.95. With stronger returns in 2025, silver could cross the USD 50 mark and outperform gold this year.

ED Files Chargesheet Against

The Enforcement Directorate (ED)’s case is based on a scheduled offence filed by Mumbai’s Matunga police under IPC sections 420 (cheating) and 120(B) (criminal conspiracy). The ED has alleged the conspiracy was aimed at obstructing the takeover of REL by the Burman family to ensure the accused continued to enjoy sole control.

Stocks Power Higher on AI Optimism

The S&P 500 Index (PX ) (SPY ) on Wednesday closed up +0. 58%, the Dow Jones Industrials Index (OWI ) (DIA ) closed unchanged, and the Nasdaq 100 Index (UXX ) (QQQ ) closed up +1. 19%. December E-mini S&P futures (ESZ25 ) rose +0. 60%, and December E-mini Nasdaq futures (NQZ25.

From Greed To Fear: Expert Says 2026 Bitcoin Bubble Will Dwarf 2017

A prominent macro-crypto commentator argues that digital assets are transitioning from a greed-driven cycle to a fear bubble, with Bitcoin poised for a more powerful and more parabolic phase in 2026 than the euphoric surge of 2017. In a post on X from October 8, the analyst known as plur_daddy (@plur_daddy) contends that two narrativesmonetary debasement and artificial intelligenceare now the dominant behavioral drivers, and that they operate less on promise than on anxiety. 2017 Vibes: Trump And AI Could Ignite Next Bitcoin Rally We are in a bubble, and the most parabolic leg is approaching. The true fireworks will be next year but this Q4 we shall get a taste, he wrote, adding that the stories animating this cycle are fueled by twin narratives: debasement and AI. What is especially potent about these stories is the way they operate on fear, not hope. You NEED to buy gold/BTC to avoid getting your net worth debased away, and you NEED to have AI exposure to offset your future loss of labor market value. While the themes are familiar to market professionals, he argues they have not yet been fully internalized by the broader public or by bureaucratic real money funds such as pensions and endowments, which he characterizes as slow to reposition for debasement risk. The result, he suggests, is under-owned exposure that can be forced higher once allocation committees catch up. There is also a lot of investor capital that still hasn’t reflected these views yet, he wrote, laying the groundwork for what he believes will be a structurally higher demand base for both Bitcoin and gold as the cycle matures. Related Reading: Bitcoin Will Not Crash: Jeff Park Rejects Paul Tudor Jones 1999 Comparison A central pillar of his thesis is a policy pivot he expects under the current administration, which he describes as shifting in a pro-cyclical manner, leaning hard into the bubble, and ready to step on the gas ahead of the midterms. He outlines four channels. First, Trump Fed Hijacking, shorthand for rate cuts followed by yield curve control to cushion the bond market and stimulate housingtimed most likely. not. until May of next year, which he frames as the ignition point for the final, steep ascent. Second, a Treasury issuance tilt to bills to pull down long-end yields and free up risk appetite. Fourth, stimulus checks delivered through budget reconciliationpolitically contested, he concedes, but with decent odds of prevailing given ironclad party control. Each mechanism, as he describes it, reduces financial frictions at the same time that fear-based narratives pull new capital into hard assets and AI-adjacent equities. The macro mix, in his view, is complicated but ultimately supportive. The economy is not robust, but it is chugging along, floated by AI capex. a two speed economy, with real world businesses and the average consumer not doing great, but the high end and asset owners are soaring. Moments later he sharpened the framing: the two speed economy makes it goldilocks as the genuine weakness in parts of the economy creates a justification for continued fiscal/monetary stimulus while continuing to benefit asset owners. Be the asset owner, the beneficiary of it all. This is the crux of the fear bubble argument: soft spots provide the political cover for policy support, while debasement concerns and job-market anxieties around AI keep households and institutions defensively overweight exposure to scarce assets and growth narratives. Why Q1 2026 Could See A Bitcoin Rally Pause For Bitcoin specifically, he lays out a path that interleaves seasonal strength, cycle reflexivity, and a final acceleration. My base case is a strong Q4 for BTC, then a sharp downturn as the 4 year cycle debate must be played out in the markets, and finally a rebound that leaves doubters in the dust. He later endorsed the possibility of truly manic vertical days at the very end. Similar in vibes to early Dec 2017 in BTC, invoking the last cycles most frenetic stage but recasting the psychology from greed to fear-driven defensiveness. Related Reading: Bitcoins On-Chain Roadmap Shows $111,000 $143,000 As The Range To Watch The thread triggered broader speculation about end-cycle dynamics. Responding to a scenario from another usersome kind of point in 2026 or 2027 where everyone collectively decides that the USD is going to 0 very quickly and impulsively buys whatever they can to get rid of it. Everything pumps +30% for 3 days straight. And then that is the topplur_daddy didnt endorse the currency-collapse framing but did agree on the truly manic vertical days at the very end. Despite the bullish architecture, the analyst does not claim the underlying economy is healthy or that the path will be smooth. This is an environment where you want to stay long over the next 12 months, but you should be thoughtful in shifting portfolio composition between gold, BTC, and stocks, he wrote, describing a rotation that acknowledges both macro dispersion and the possibility of sharp drawdowns en route to a higher peak. The bottom line of his thesis is unambiguous: the next stage of this cycle is fear-led, policy-fueled, and likely to exceed 2017s magnitude. The difference, he argues, is psychological and structural. Where 2017 fed on retail euphoria, 202526 is animated by the defensive compulsion to preserve purchasing power and job relevancefear. is a much more potent driver of behavior than hope or even greed. If his timeline holds, a taste in Q4, a shakeout on cycle debates, and a policy-catalyzed vertical in 2026 could define Bitcoins next act. At press time, BTC traded at $122,512. Featured image created with DALL. E, chart from TradingView. com.

Salman Khan resolves Rs 7.24 crores Jerai fitness dispute, withdraws NCLAT appeal

Bollywood actor Salman Khan has resolved his Rs 7. 24 crores dispute with Jerai Fitness Limited, leading to the withdrawal of his insolvency appeal before the National Company Law Appellate Tribunal (NCLAT). The settlement pertains to a trademark license agreement under Khans fitness brand, Being Strong. On October 6, Khan’s legal counsel informed the NCLAT that the consent terms had been executed. Subsequently, on October 8, the tribunal recorded the consent terms and permitted the actor to withdraw his appeal. The bench, comprising Chairperson Justice Ashok Bhushan and Technical Member Arun Baroka, dismissed the appeal as withdrawn. The dispute arose from a 2023 agreement between Khan and Jerai Fitness, which allowed the latter to manufacture, market, and sell gym equipment under Khan’s trademark. Under this agreement, Jerai was obligated to pay either a minimum guarantee of Rs 3 crores annually or 3% of net sales, whichever was higher. Khan alleged that Jerai defaulted on invoices amounting to Rs 7. 24 crores, including a one-time settlement payment of Rs 1. 63 crores for the pre-March 2023 period and royalties for subsequent years. Jerai Fitness contested these claims, arguing that Khan had failed to fulfil his obligations under the agreement. The company contended that Khan did not provide timely approvals for product designs and promotional materials and did not attend the launch of its Proton series at the Bombay Exhibition Centre in November 2023. Jerai maintained that the invoices relied on by Khan were raised only after the company had issued a termination notice in September 2024, effective April 2025, and therefore could not form the basis of an insolvency claim. The NCLT Mumbai Bench had dismissed Khan’s insolvency plea in May, stating that while the Rs 1. 63 crores settlement amount for the earlier period was an undisputed liability, the larger royalty claim was subject to a genuine pre-existing dispute regarding Khan’s performance under the agreement. The tribunal concluded that the petition fell within the domain of recovery proceedings rather than resolution under the Insolvency and Bankruptcy Code (IBC). Following this dismissal, Khan approached the NCLAT, challenging the decision. However, with the recent settlement and withdrawal of the appeal, the matter has been resolved amicably between the parties. Khan was represented by Advocates Varun Kalra, Parag Khandhar, Tapan Radkar, and Shaham Ulla from DSK Legal, while Jerai Fitness was represented by Advocates Himanshu Satija, Prerna Wagh, Prangana Baraua, Pranav Saigal, Harshit Khanduja, Harsh Saxena, and Anshul Rao. Also Read : Director J. K. Bihari on casting Salman Khan in Biwi Ho To Aisi, I just judged him by his walk.

Government To Pull Off IDBI Bank Stake Sale, Rules Out UPI Transaction Charges

As per the government, the stake sale will help it comply with the Securities and Exchange Board of India’s requirement that listed companies maintain a minimum public shareholding of 25 per cent.

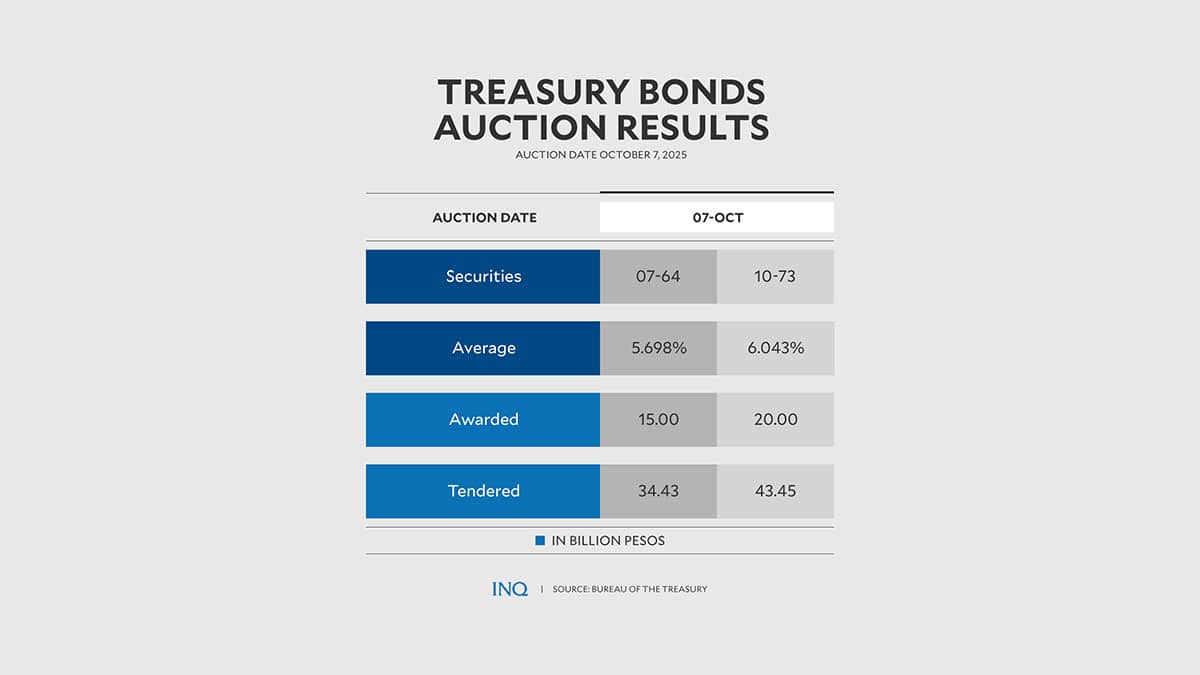

Treasury hits P35-B bond sale target amid strong demand, lower yields

MANILA, Philippines – The government was able to raise its target amount of long-dated local debt on Tuesday’s dual Treasury bond sale, as yields fell below benchmarks. The Bureau of the Treasury borrowed P15 billion via reissued T-bonds, which have a remaining life of two years and six months. Demand for the debt paper reached