Cardano Network Split After Software Bug – FBI Gets Involved

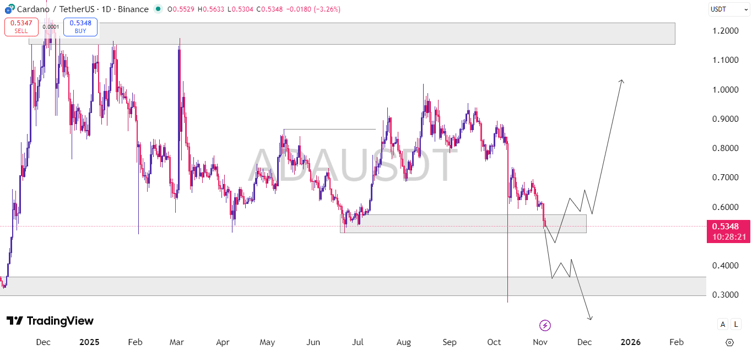

The post Cardano Network Split After Software Bug FBI Gets Involved appeared com. The Cardano (ADA) ecosystem faced an unexpected shock when the network briefly split into two parallel chains due to a rare software flaw. A staking-pool operator triggered a previously unknown bug, causing nodes to disagree on chain validity and temporarily fragmenting the blockchain. While the issue has been resolved through rapid node upgrades, the incident escalated dramatically when Cardano founder Charles Hoskinson announced that the FBI had been notified. By TradingView ADAUSD_2025-11-23 (5D) What Actually Happened? A Delegation Transaction Broke Consensus The disruption began when a staking pool operator known as “Homer J” submitted a delegation transaction crafted with the help of an AI-generated code snippet. The transaction was technically valid under Cardano rules. But, it triggered a long-standing, dormant bug that had never been hit before. As a result: Some nodes accepted the transaction Others rejected it The blockchain forked into two active versions The consensus temporarily broke This type of issue is extremely rare and represents one of the most serious possible failures for any blockchain. How Serious Was the Cardano Network Split? A temporary chain split can lead to: Conflicting transaction histories Orphaned or invalidated transactions In extreme cases, double-spending According to early analyses, a few double debits may have occurred, but the incident was quickly contained as operators were instructed to upgrade to the new, fixed software. The core network has since reconverged onto a single chain. Hoskinson Calls It a Criminal Act FBI Notified Charles Hoskinson escalated the situation by stating that the event constitutes a serious crime, describing it as a deliberate attack on the security of the network. He also announced that the FBI was contacted to investigate potential malicious intent behind the triggering of the bug. While the operator “Homer J” has accepted responsibility and claims it was unintentional, Hoskinson is.