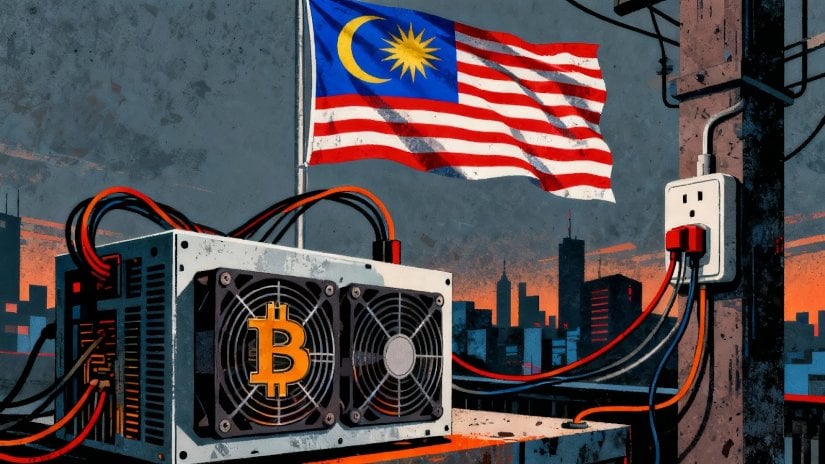

The post Malaysia Uncovers $1. 11 Billion Crypto Power Theft Spanning 13, 827 Illegal Mining Sites appeared com. Malaysia’s national electricity provider has revealed one of the largest cryptocurrency-related power theft scandals in history. Tenaga Nasional Berhad (TNB) lost over $1. 11 billion between 2020 and August 2024 due to illegal crypto mining operations that bypassed electricity meters across nearly 14, 000 locations. The Energy Ministry disclosed these shocking figures in a parliamentary filing on November 19, 2025. The scale of theft represents 4. 57 billion Malaysian ringgit in lost revenue and highlights serious vulnerabilities in the country’s power grid infrastructure. Massive Scale of Underground Operations TNB identified 13, 827 premises engaged in illegal cryptocurrency mining between 2020 and August 2024. These operations ranged from small residential setups to large-scale industrial facilities, all stealing electricity to power Bitcoin mining equipment. The illegal mining operations primarily targeted Bitcoin, which requires enormous amounts of electricity to operate. Criminal groups established sophisticated networks across Malaysia, using rented warehouses, shops, and residential homes with minimal foot traffic to avoid detection. These syndicates installed heavy-duty ventilation systems, air conditioning, and soundproofing materials to mask the noise and heat generated by mining equipment. To stay ahead of authorities, operations frequently relocated every few months, making enforcement challenging for utility providers and law enforcement. Explosive Growth in Crypto-Related Power Theft The problem has grown dramatically over recent years. Power theft cases linked to illegal crypto mining increased by 300% between 2018 and 2024. Detected incidents jumped from 610 cases in 2018 to 2, 397 cases in 2024. Between 2020 and 2024, TNB recorded an average of 2, 303 electricity theft cases annually related to cryptocurrency activities. The utility company also received approximately 1, 699 crypto-related complaints between January 2020 and December 2024, reflecting growing public awareness of illegal mining activities in their neighborhoods. Earlier reports showed how losses escalated over time. In 2020, TNB reported relatively modest losses of 5. 9 million ringgit.