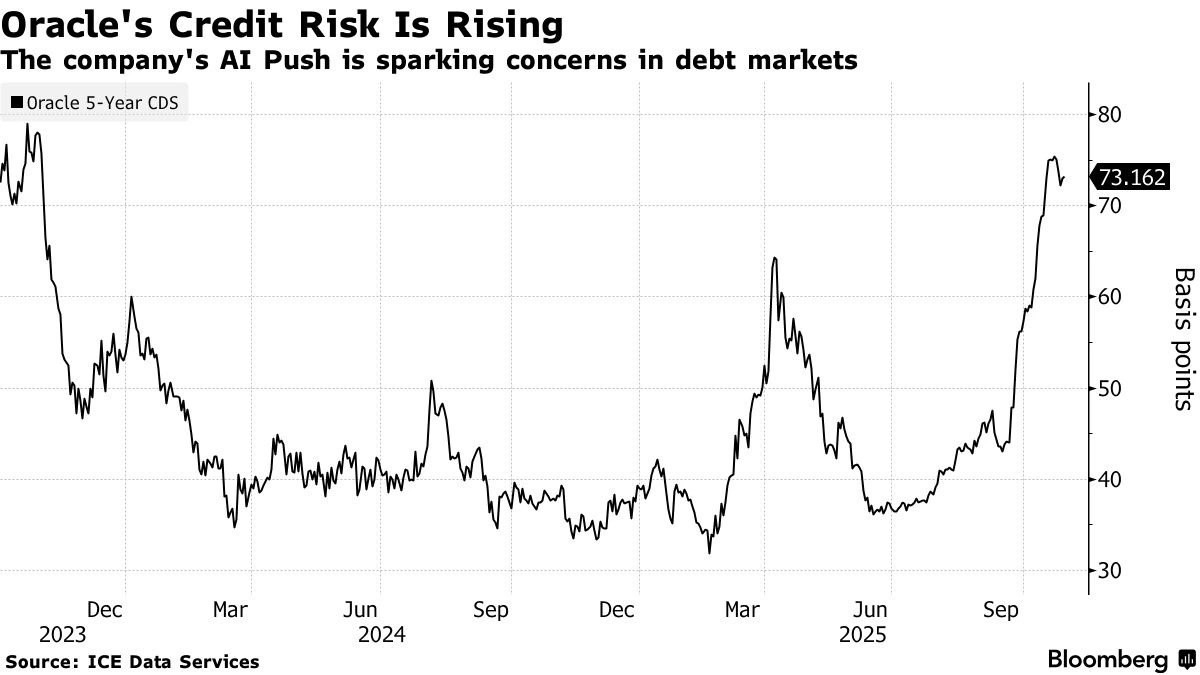

Credit traders have been pricing in the possibility of Oracle defaulting on its debt

The post Credit traders have been pricing in the possibility of Oracle defaulting on its debt appeared com. Credit traders have been ramping up purchases of credit default swaps (CDS) on Oracle (RCL) as a hedge against potential default risks. The hedgers have been encouraged by JPMorgan analysts and the company’s aggressive borrowing to fund its AI infrastructure expansion, especially now that it has been revealed that the cost of insuring Oracle’s debt over the next five years has surged to near its highest level since October 2023. The cost of insuring Oracle’s debt over the next five years has surged to near its highest level since October 2023. defaulting on its debt, a trend that Morgan Stanley predicts will continue in the near term as the company funnels billions into the AI sector. The cost to insure against default on the company debt over the next five years now hovers near its highest since October 2023, according to ICE Data Services. The tech giant’s 4. 9% bonds, expected to mature by February 2033, also increased from 26 basis points to 83 basis points earlier today. By the fiscal year of 2028, Morgan Stanley expects Oracle’s net adjusted debt to grow to more than double its current size, pushing it to roughly $290 billion from around $100 billion. The company’s analysts have urged investors in Oracle to purchase the company’s five-year CDS and its five-year bonds. “Near-term credit deterioration and uncertainty may drive further bondholder and lender hedging,” Morgan Stanley analysts Lindsay Tyler and David Hamburger declared in a note Monday. Nobody is mandated to take the advice, but investors have been worked into a frenzy as they attempt to safeguard their exposure. Reports also.