Helium’s Buyback and Rising DEX Activity Signal Potential HNT Price Reversal

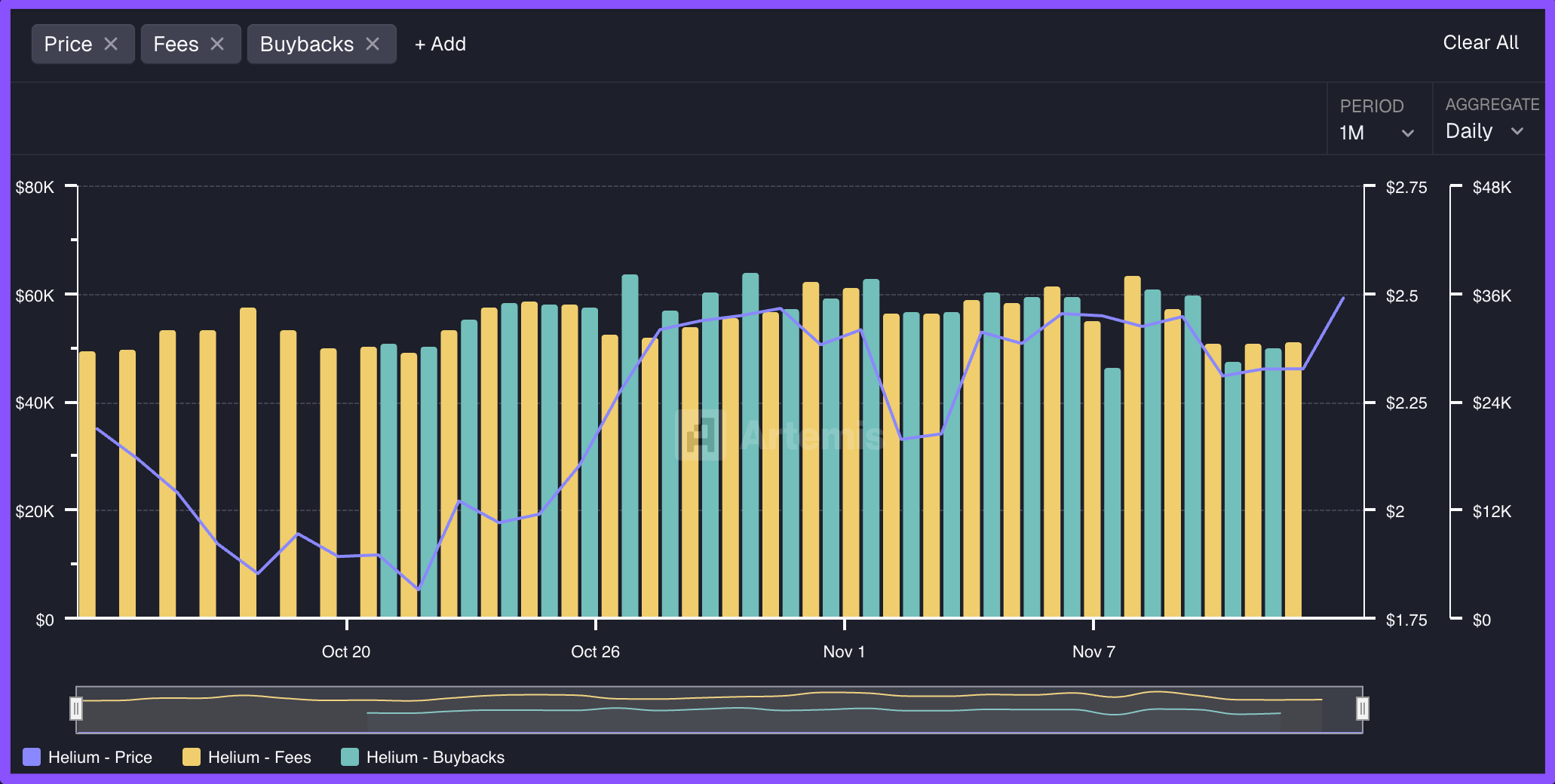

The post Helium’s Buyback and Rising DEX Activity Signal Potential HNT Price Reversal appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → The Helium HNT buyback program, launched on October 20, 2025, has driven the token’s 16% monthly price increase by reducing circulating supply through fee-funded repurchases. Rising DEX trading volumes and token transfers further support this momentum, potentially signaling a bullish reversal if key support levels hold. Helium’s buyback initiative uses network fees to repurchase HNT tokens, averaging $30,000 monthly and tightening supply. Increased DEX activity shows $3 million in trading volume, the highest weekly figure, with buy orders outpacing sales. Price action forms an inverted head-and-shoulders pattern, holding above $2 support, with potential upside to $4 if $2. 74 resistance breaks. Discover how Helium’s HNT buyback program is fueling price growth amid rising on-chain metrics. Explore the latest analysis and what it means for investors in 2025. What is the Helium HNT buyback program? The Helium HNT buyback program is a mechanism implemented by the Helium Network to utilize collected fees for repurchasing its native HNT tokens, thereby reducing the circulating supply and supporting price stability. Launched on October 20, 2025, this initiative has enabled consistent token repurchases, with an.