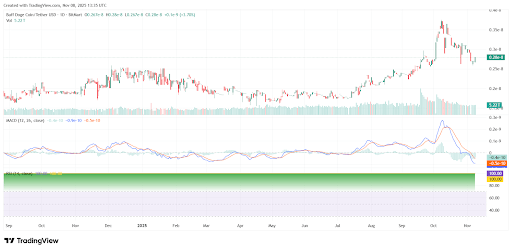

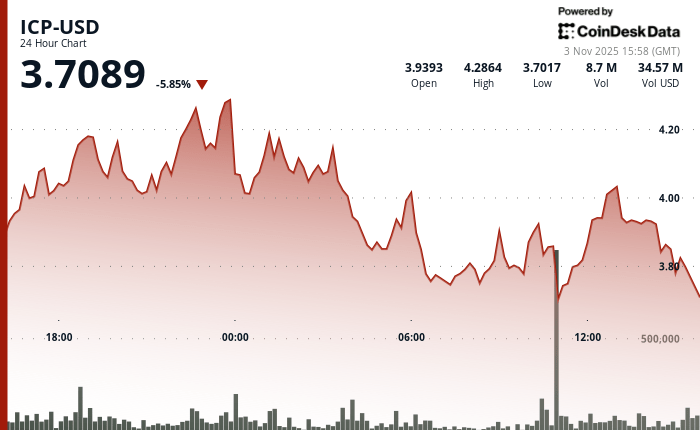

The post Dogecoin Rebounds from 200 EMA Support, Suggesting Possible Bullish Momentum appeared com. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → Dogecoin has rebounded from its key 200 EMA support level, maintaining a bullish structure with higher highs and lows. This reset signals renewed accumulation amid market corrections, holding steady near $0. 177 as moving averages align downward. Dogecoin tested the 200 EMA multiple times, each rebound reinforcing the ongoing bull phase with rising channel patterns. Buff Doge Coin experienced a mid-year surge from 0. 27e-8 to 0. 35e-8, followed by a correction to 0. 26e-8, showing steady participation. Dogecoin’s 50-day and 200-day averages indicate bearish alignment, with price stabilizing at $0. 177 after declines from $0. 29. Dogecoin 200 EMA support rebounds spark trader interest in 2025 bull cycle. Explore key levels, Buff Doge Coin trends, and moving average signals for informed crypto strategies-stay ahead of the market reset today. What is Dogecoin’s 200 EMA Support and Its Role in the Current Bull Phase? Dogecoin’s 200 EMA serves as a critical long-term support indicator, where the price has tested this level six times in the current cycle, rebounding each instance to sustain higher highs and lows. This exponential moving average, calculated over 200 periods on.