**Spokane Public Schools Highlights “Two Cents” Tax Increase on November Bond Ballot**

Spokane Public Schools is emphasizing a modest tax impact when publicizing its upcoming $200 million bond measure on the November ballot. The district is asking voters to grant authority to issue bonds for school improvements, which would be paid off over 20 years.

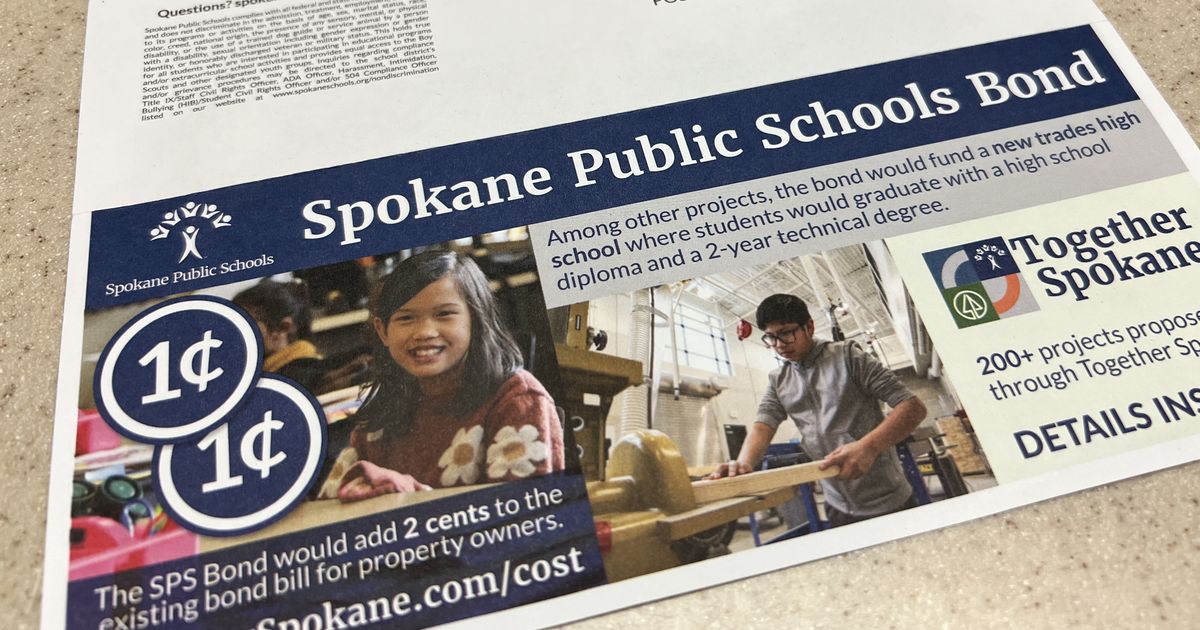

A recent mailer sent to voters claimed the new bond would only add “2 cents to the existing bond bill for property owners.” However, the accuracy of this claim depends on how the increase is calculated. The district’s informational materials and online tax calculator show a more nuanced effect on individual tax bills, including variations that result in both increases and decreases.

—

### Understanding the “2 Cents” Increase

The “2 cents” referenced in the mailer relates to the “mill rate,” which is the property tax cost per $1,000 of assessed value. Currently, Spokane homeowners pay about $1.34 per $1,000 of assessed property value on existing school bond debt from bonds approved in 2009 and 2018.

For a home valued at $400,000—the median price in Spokane—that equates to roughly $536 per year on existing school bonds.

If the new bond measure passes, the total school bond rate will increase by 2 cents to $1.36 per $1,000 in 2025, adding approximately $8 annually to the bond portion of the property tax bill. This brings the total bond tax to about $544 on a $400,000 home.

There would be an additional 2-cent increase the following year, adding another $8 annually in 2026, raising the rate to approximately $1.38. By 2028, the district estimates the rate will reach $1.50 per $1,000, at which point a homeowner with a $400,000 property would pay about $600 annually—$64 more than the current tax.

The $1.50 rate is expected to remain steady through 2030, according to school officials.

—

### What Happens After 2030?

Beyond 2030, bond rates depend on several factors including bond market volatility, the district’s future capital needs, and voter decisions. Unlike school levies, which generally remain stable over their term, voter-approved bonds give the district flexibility on when and how much debt to issue. This flexibility influences the annual tax impact on homeowners.

Projections from the district estimate the bond rate will decline to 89 cents in 2039, drop further to 36 cents by 2041, and fall to 7 cents in 2048. These projections reflect the district’s ability to manage bond sales strategically to balance taxpayer burden with financial needs.

—

### Complexity of Bond Calculations

James Hawvermale, a levy specialist with the Spokane County Assessor’s Office, highlights the complexity of estimating bond impacts for taxpayers. He explains that the school district typically has multiple active bonds, refinancing them regularly with numerous variables affecting tax rates.

“We decided not to go anywhere near trying to estimate bonds,” Hawvermale said. “Spokane Public Schools usually have four or five bonds out and refinance those often. It’s very complex to track.”

—

### District’s Approach to Bond Management

Cindy Coleman, the district’s Chief Finance Officer, said the district works closely with bond counsel and financial advisors to manage bond debt in a way that maximizes value and keeps tax rates stable. She credits this approach for the district’s consistent tax rates over the past 20 years.

Superintendent Adam Swinyard expects the bond rate to remain relatively flat over the next 15 years as older bonds are paid off.

—

### Impact of Property Value Changes

Spokane County Treasurer Mike Volz notes that while tax rates may stay stable, rising property values will increase the actual amount homeowners pay. This is different from school operation levies, which do not necessarily increase with property values.

For example, if a $400,000 property’s value rises by 3% next year, the bond tax would increase by approximately $16 annually.

—

### Strategic Debt Issuance

Swinyard emphasized the district’s strategic approach to issuing new debt if the bond passes. The district does not take on all debt immediately; instead, new debt is added carefully to secure favorable rates and minimize taxpayer burden.

—

For Spokane homeowners, the proposed school bond measure represents a modest, manageable increase in property taxes aimed at funding important school improvements while maintaining financial stability for the community.

http://www.spokesman.com/stories/2025/oct/18/truth-tester-spokane-public-schools-stresses-2-cen/