**Credit Traders Increase Purchases of Oracle (RCL) CDS Amid Rising Default Risk Concerns**

Credit traders have been ramping up purchases of credit default swaps (CDS) on Oracle (RCL) as a hedge against potential default risks. This surge in hedging activity has been encouraged by JPMorgan analysts and Oracle’s aggressive borrowing to fund its AI infrastructure expansion.

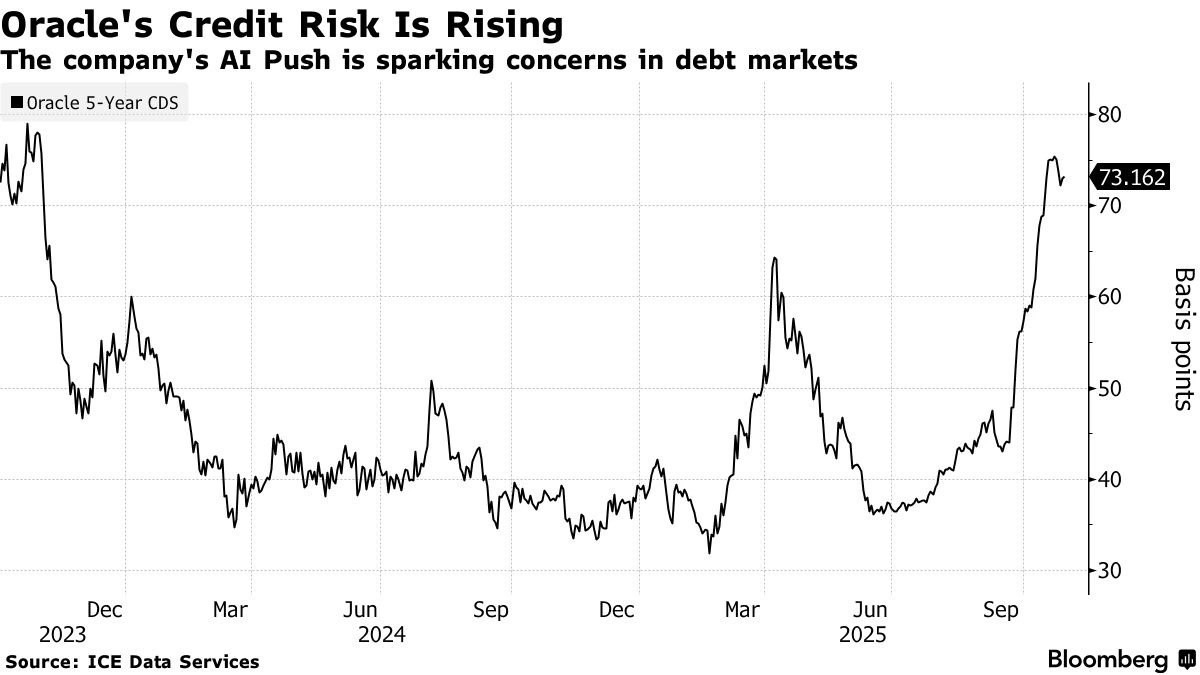

Recently, it was revealed that the cost of insuring Oracle’s debt over the next five years has surged to near its highest level since October 2023. This development has added to investors’ mixed feelings about Oracle’s ballooning debt load.

—

### Growing Concerns Over Oracle’s Debt

According to a Bloomberg report, credit traders are increasingly buying CDS as protection against the possibility of Oracle defaulting on its debt. Morgan Stanley predicts this trend will continue in the near term as the company funnels billions into the AI sector.

Data from ICE Data Services shows that the cost to insure against default on Oracle’s debt over the next five years now hovers near its highest level since October 2023. The tech giant’s 4.9% bonds, which mature by February 2033, also saw their spreads increase from 26 basis points to 83 basis points earlier today.

Morgan Stanley forecasts that by fiscal year 2028, Oracle’s net adjusted debt will grow to more than double its current size—rising from around $100 billion to roughly $290 billion. In light of this, the company’s analysts have urged investors to purchase Oracle’s five-year CDS and bonds to safeguard their positions.

“Near-term credit deterioration and uncertainty may drive further bondholder and lender hedging,” Morgan Stanley analysts Lindsay Tyler and David Hamburger said in a note on Monday.

—

### Massive AI Infrastructure Funding Push

Reports indicate that banks are preparing to launch a $38 billion debt offering for Oracle, set to help fund new data centers. This would be the largest such deal for AI infrastructure witnessed in the market to date.

The proceeds will be used to build data centers in Texas and Wisconsin, part of Oracle’s broader $500 billion investment plan in AI infrastructure alongside OpenAI’s Stargate project.

Nicholas Elfner, co-head of research at Breckinridge Capital Advisors, predicts some interesting plays in the secondary market as large corporate bond issuers like Oracle rapidly expand their debt balances, increasing their weight in credit indexes.

“Index trackers may add to the name to maintain their weight,” Elfner said. “Others with a negative credit view may buy CDS protection to hedge holdings or make a bet on spread widening.”

Oracle currently holds about $95 billion of outstanding debt, making it the largest corporate issuer outside the financial sector in the Bloomberg high-grade index.

—

### Diverging Views on Oracle’s Default Risk

While traders and analysts echo concerns over the surge in CDS and Morgan Stanley’s debt forecast, others dismiss worries about default risk. Oracle’s consistent ability to generate strong cash flow from its cloud and AI deals offers a buffer against default fears.

—

### AI Bubble Warnings Persist Amid Market Optimism

The AI-driven rally has undeniably been a major force in U.S. equities throughout 2025. The S&P 500 and Nasdaq Composite both recorded multiple new highs in October, with the S&P surpassing 6,000 for the first time due to broad tech gains and optimism over AI-driven productivity boosts.

AI infrastructure spending is now projected to reach $200 billion annually, helping offset economic headwinds like persistent inflation and geopolitical tensions. Technology now accounts for over 30% of the S&P 500’s weighting, with the Nasdaq significantly outperforming the broader market.

However, skepticism looms as some analysts and investors draw parallels to the dot-com bubble of the early 2000s. AI-related stocks have driven more than 60% of the S&P’s year-to-date gains, with valuations stretched and venture funding in unprofitable AI startups soaring since 2023 without clear revenue proof.

—

### Expert Cautions on AI Investment Risks

Institutions including Goldman Sachs and JPMorgan have flagged the risk of a “rotation” away from AI stocks if earnings disappoint. Meanwhile, safe-haven assets like gold and Bitcoin have surged alongside equities, indicating that some investors remain cautious.

Jeremy Grantham, co-founder of GMO and renowned for predicting major market bubbles like the 2000 dot-com crash and 2008 financial crisis, labeled AI a “bubble waiting to pop.” He compared it to the 19th-century British railroad mania, which crashed after overhyped infrastructure spending.

Grantham warned that while AI could drive long-term efficiency, “like any world-changing technology [it] will eventually crash and hurt investors.”

Others sharing this cautious view include Goldman Sachs CEO David Solomon, Amazon founder Jeff Bezos, and even insiders like Sam Altman, who warned in October 2025 that “people will overinvest and lose money” during the AI phase.

—

**Ready to start trading? Get up to $30,050 in trading rewards when you join Bybit today!**

https://bitcoinethereumnews.com/finance/credit-traders-have-been-pricing-in-the-possibility-of-oracle-defaulting-on-its-debt/?utm_source=rss&utm_medium=rss&utm_campaign=credit-traders-have-been-pricing-in-the-possibility-of-oracle-defaulting-on-its-debt