**Crypto Market Correction Intensifies: Dogecoin’s Death Cross, Bitcoin Battles Sell Pressure, and Ethereum Stabilizes**

The crypto market is undergoing a significant correction, with major digital assets showing bearish technical signals and declining netflows. Dogecoin confirms a death cross, Bitcoin struggles against a massive sell wall, and Ethereum finds critical support at $3,000. This 2025 update delves into the key levels, market implications, and what investors need to know moving forward.

—

### What Is Driving the Current Crypto Market Correction?

The correction is fueled primarily by declining netflows and widespread bearish technical indicators across major cryptocurrencies. While larger coins like Bitcoin and Ethereum exhibit slower declines, more volatile assets such as Dogecoin are rapidly losing support.

Momentum indicators reveal oversold conditions; however, sustained selling pressure suggests that the market may experience further downside before stabilization occurs. This environment calls for cautious positioning among investors.

—

### How Has Dogecoin’s Death Cross Impacted Its Price Trajectory?

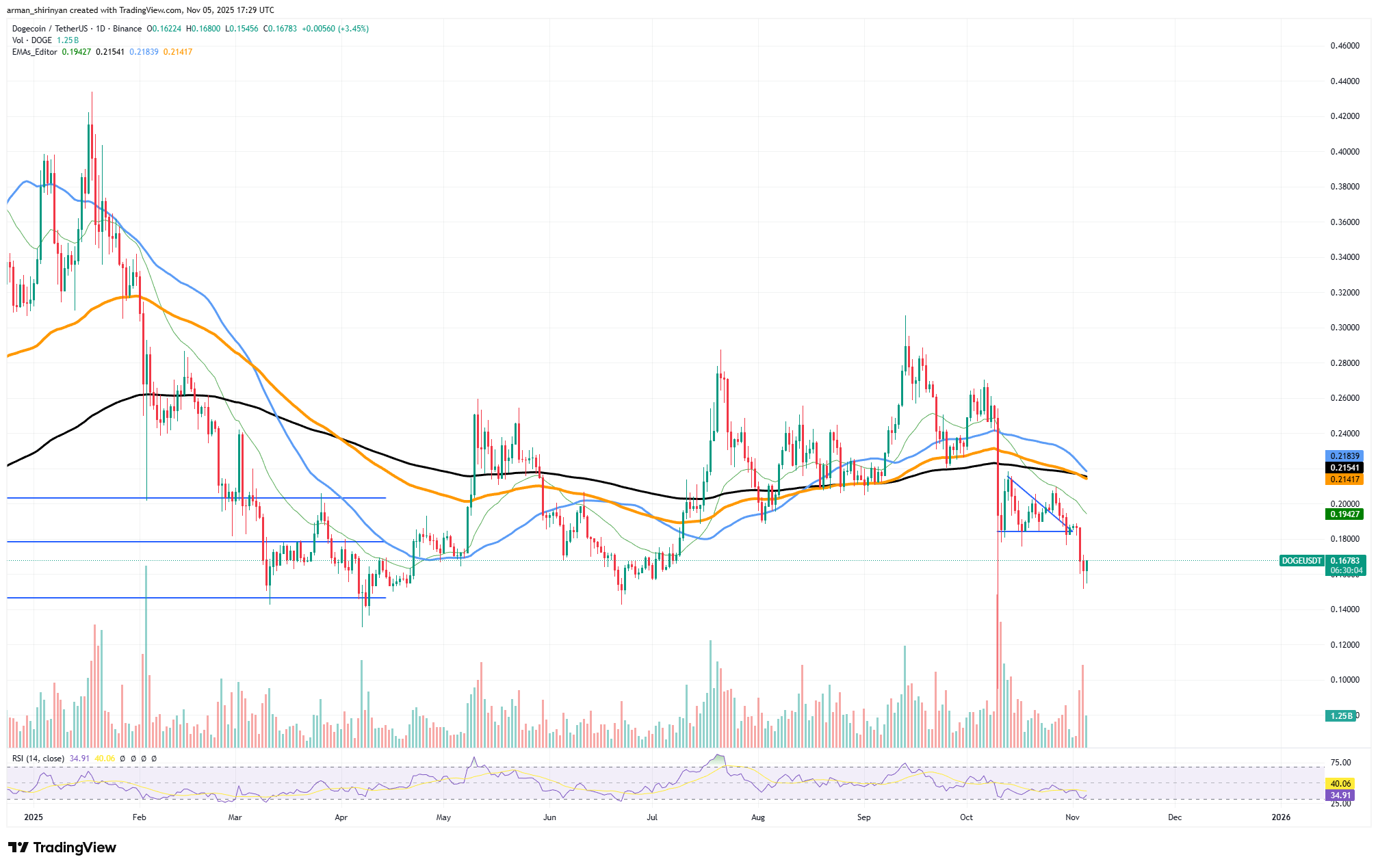

Dogecoin recently experienced a death cross, a classic bearish signal occurring when the 50-day moving average crosses below the 200-day moving average. Historically, this pattern is associated with extended downturns in cryptocurrency prices.

Since early September, Dogecoin’s price has steadily declined from a yearly high above $0.30 to around $0.165. TradingView charts show that it has broken below the critical $0.18 support level, potentially opening the door for deeper retracements toward the $0.14–$0.15 demand zone.

The Relative Strength Index (RSI) for Dogecoin stands at 39, nearing oversold territory but not quite signaling capitulation. This suggests there is still room for additional declines. Swing traders may interpret the pattern as a sell signal amid thinning liquidity, while long-term holders now face significant resistance from previous support levels turned into barriers.

Unless Dogecoin can reclaim the $0.20 threshold soon, bearish dominance is expected to persist through 2025, with the possibility of retesting prior lows near $0.12–$0.13. Market analysts, drawing on historical parallels from Bitcoin’s 2022 slump, caution that death crosses often precede multi-month price declines.

External factors such as social media hype or celebrity endorsements could produce temporary price spikes, yet the overall technical outlook remains cautious. Investors should prepare for continued volatility.

—

### Why Is Bitcoin Entering a Correction Phase Now?

Bitcoin’s correction is largely driven by a formidable $500 million sell wall on major exchanges, which has overwhelmed buying efforts and caused the price to break below the $100,000 psychological barrier.

Despite minor intraday recoveries, the broader market structure reveals exhausted bullish momentum. Large holders appear to be liquidating positions accumulated near the $90,000–$100,000 range in previous cycles. Order book data from exchanges highlight this supply imbalance, hampering meaningful rebounds until it is resolved.

On the daily chart, Bitcoin has fallen below the 200-day moving average for the first time since early 2024, indicating the start of a potential extended downtrend following its prior rally. Additionally, the 50-day and 100-day moving averages are trending downward, confirming a loss of medium-term strength.

With RSI at 32.7, Bitcoin nears oversold levels, but persistent selling pressure driven by panic and forced liquidations keeps expectations for a sustained rally low. Key support levels at $98,000 and $92,000 will be closely watched if the sell wall persists, while reclaiming the $108,000 resistance mark could signal a potential shift in momentum.

Experts from platforms like CoinMarketCap emphasize that the current volume spikes during sell-offs reflect dominant bearish sentiment, keeping a sustainable recovery out of reach in the near term.

—

### What Stabilization Signals Are Emerging for Ethereum?

Ethereum is showing signs of stabilization following a severe correction. After dropping below $3,600 in mid-October, it has consolidated around the $3,000 level, which has historically acted as strong support.

This floor has absorbed aggressive selling and attracted initial buying from long-term accumulators. The daily chart, however, indicates Ethereum remains below its downward-sloping 50-day and 200-day moving averages, maintaining a bearish bias.

Nevertheless, the rebound from $3,000–$3,100 accompanied by rising buy volume suggests early accumulation. The RSI at 30.6 places Ethereum in deeply oversold territory, a condition that in past cycles has preceded sharp but often short-lived upswings.

A successful push above the $3,800–$4,000 resistance zone could target further gains toward $4,200–$4,300, providing a potential relief rally. Conversely, failure to surpass the 200-day moving average may trap Ethereum in prolonged sideways action or even lead to testing lower support levels near $2,800.

Technical experts highlight that the endurance of the $3,000 support level will be critical in dictating Ethereum’s recovery potential. Additionally, upcoming network upgrades and macroeconomic factors may provide long-term support into late 2025.

—

### Frequently Asked Questions

**What does Dogecoin’s death cross mean for investors in 2025?**

Dogecoin’s death cross is a bearish technical shift indicating that the 50-day moving average has crossed below the 200-day moving average. Historically, this pattern leads to extended price declines. With Dogecoin trading around $0.165, investors should closely monitor key support levels at $0.14–$0.15 and prepare for increased volatility. Social dynamics and news events could influence short-term price moves, but risk management remains crucial amid this technical warning.

**Is Bitcoin’s correction temporary, and how does it affect the broader market?**

Bitcoin’s current correction appears structural rather than temporary, driven by a large sell wall and broken support moving averages. This weakness impacts the broader crypto market by reducing liquidity and dampening investor sentiment. Altcoins such as Ethereum may follow suit, though oversold RSI readings indicate potential for brief rebounds. Overall, the correction underscores a cautious phase in the market, where diversified strategies are advisable.

—

### Key Takeaways

– **Dogecoin faces prolonged bearish pressure:** The confirmed death cross and RSI approaching oversold levels suggest a potential drop toward $0.14, with resistance at $0.20 limiting quick recoveries.

– **Bitcoin’s sell wall signals deeper correction:** Breaking below the 200-day moving average and high liquidation volumes point to key support tests at $98,000, delaying a sustained recovery until the supply imbalance clears.

– **Ethereum’s $3,000 hold is pivotal:** Oversold conditions provide a window for recovery if support holds, while failure may lead to declines toward $2,800. Early accumulation signs warrant close monitoring.

—

### Conclusion

The 2025 crypto market correction is shaping up as a critical juncture for investors. Dogecoin’s death cross signals caution with bearish momentum likely to continue unless key levels are reclaimed. Bitcoin’s challenge against massive sell pressure and technical breakdown suggests a more prolonged correction phase. Meanwhile, Ethereum’s ability to hold $3,000 provides a tentative foundation for recovery, contingent on both technical and macro factors.

Investors should remain vigilant, prioritize risk management, and watch key support and resistance levels as the market navigates this volatile period. Staying informed through expert technical analysis and adapting strategies accordingly will be essential in this evolving landscape.

https://bitcoinethereumnews.com/bitcoin/dogecoins-death-cross-looms-as-bitcoin-faces-correction-and-ethereum-eyes-stabilization/