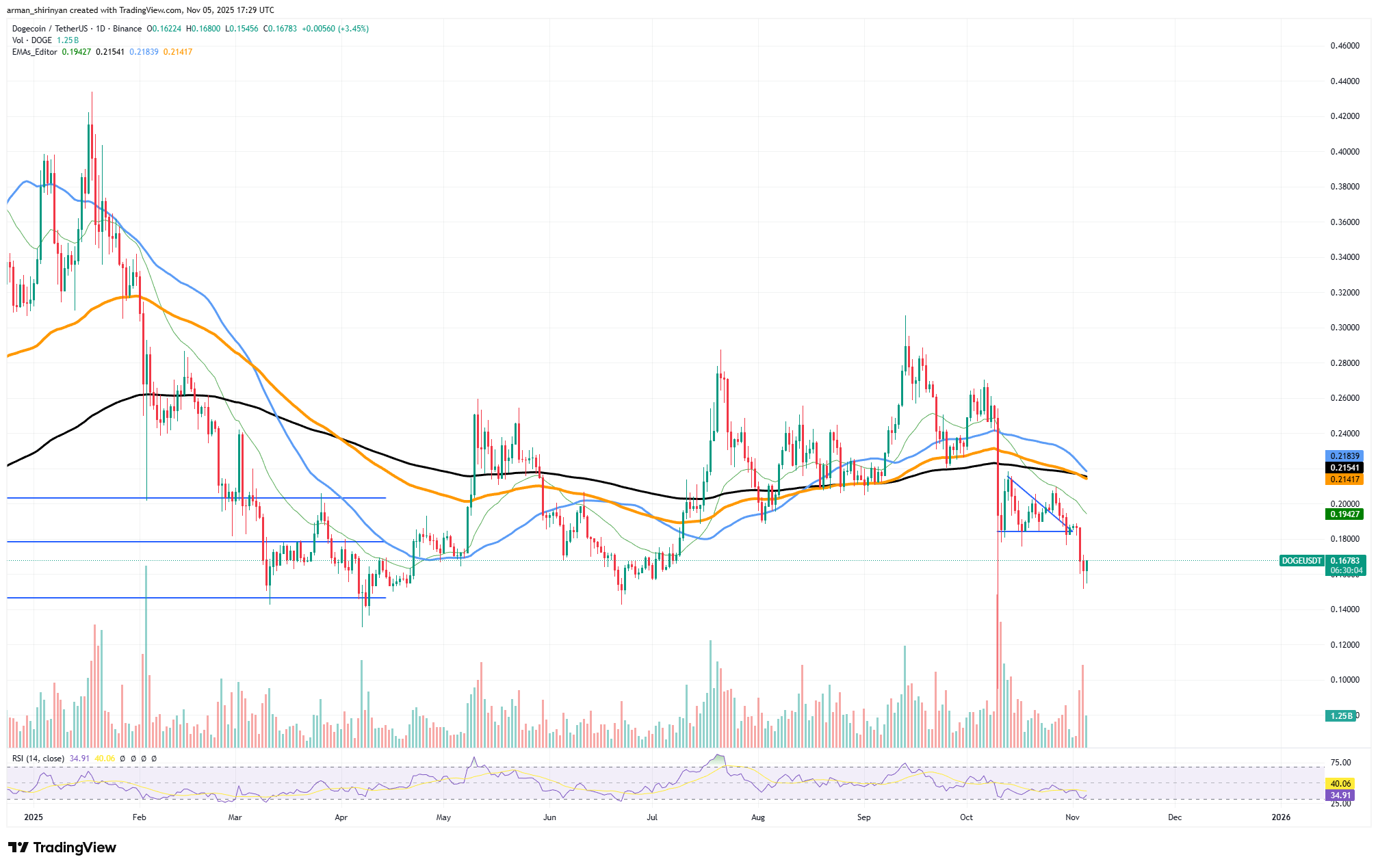

The post Dogecoin’s Death Cross Looms as Bitcocom. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → The crypto market is experiencing a downturn, with Dogecoin confirming a death cross signaling prolonged bearish momentum, Bitcoin facing a $500 million sell wall and breaking below key moving averages, and Ethereum stabilizing around $3,000 after a sharp correction. This indicates ongoing pressure on major assets amid low netflows and fading bullish sentiment. Dogecoin’s death cross confirms bearish structure, with price at $0. 165 and potential drop to $0. 14-$0. 15. Bitcoin struggles against a massive sell wall, breaking below the 200-day moving average for the first time since early 2024. Ethereum finds support at $3,000, showing oversold conditions with RSI at 30. 6, hinting at possible short-term recovery if the level holds, per technical analysis from TradingView data. Crypto market correction intensifies as Dogecoin hits death cross, Bitcoin battles sell pressure, and Ethereum stabilizes. Discover key levels and implications for investors in this 2025 update. Stay informed-read on for expert insights. What is driving the current crypto market correction? Crypto market correction is fueled by declining netflows and bearish technical signals across major assets, confirming a negative outlook. Larger coins like Bitcoin.