Rocket Lab: Neutron Rescheduled, But Showing Us All The Right Signs

Nov. 11, 2025 5:16 AM ET

Rocket Lab Corporation (RKLB) Stock

Summary

Rocket Lab delivered record Q3 revenue of $155.1 million, up 48% year-over-year, and beat EPS and revenue estimates, driving a 7% stock gain. RKLB’s growth is fueled by strong Electron launch demand, aggressive acquisitions, and expanding space systems, with improved margins and narrowing losses.

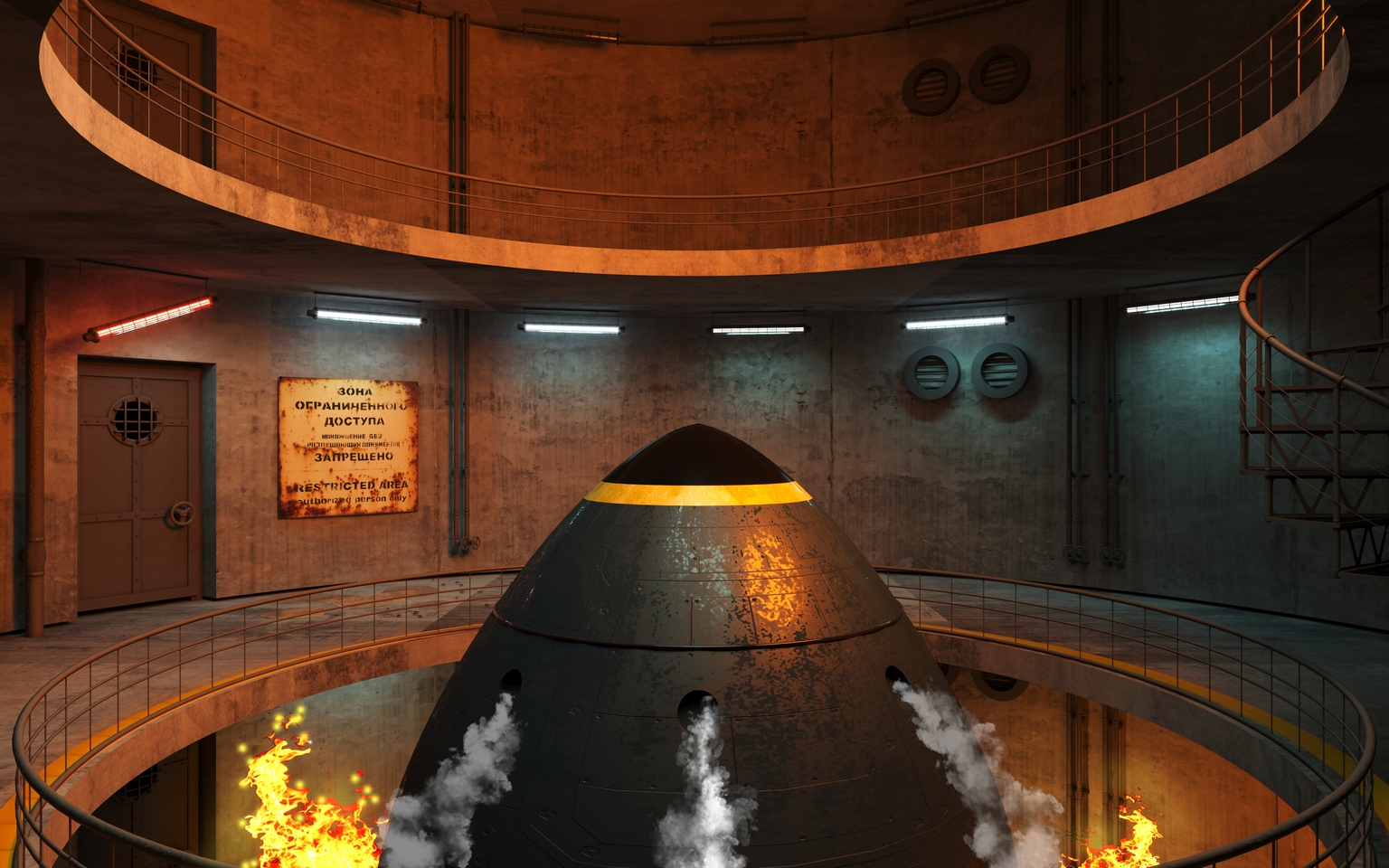

The Neutron rocket launch has been rescheduled to Q1 2026, reflecting prudent engineering; infrastructure and R&D milestones are progressing well. Despite a premium valuation, I maintain a Buy rating on RKLB, expecting continued momentum and upside as revenue accelerates and Neutron approaches launch.

Thesis

Since my previous coverage on Rocket Lab (RKLB), we’ve received several important updates on the company’s Q3 2025 earnings, including significant developments in their launch programs. The company also reported some impressive financial results that demonstrate strong operational progress.

Rocket Lab’s increased revenue growth and narrowing losses underscore its solid execution across multiple fronts, including the popular Electron launch vehicle and expanded space systems capabilities. The rescheduling of the Neutron rocket launch to Q1 2026 is a prudent move to ensure thorough engineering and testing, which should pay dividends in the long term.

Infrastructure and research & development milestones are on track, reflecting robust internal progress that supports Rocket Lab’s future growth potential.

About the Author

This article was written by a contributor with 330 followers who holds a Master’s degree in Cell Biology. Starting their career as a lab technician in a drug discovery clinic, they gained extensive hands-on experience in cell culture, assay development, and therapeutic research.

This scientific foundation instilled an appreciation for the rigor and challenges behind drug development, an approach they now apply as an investor and analyst. For the past five years, the author has been active in investing, with the last four dedicated to working as a biotech equity analyst alongside lab work.

Their focus is identifying promising biotechnology companies innovating through unique mechanisms of action, first-in-class therapies, or platform technologies poised to reshape treatment paradigms. By combining scientific expertise with financial and market analysis, they aim to deliver research that is both technically sound and investment-driven.

On Seeking Alpha, their coverage primarily centers on the biotech sector—spanning companies at various stages from early clinical development to commercial operations. The author emphasizes evaluating the science behind drug candidates, competitive landscapes, clinical trial designs, and market potential, balanced with financial fundamentals and valuation.

Their goal in publishing is to share insights that help investors better understand the opportunities and risks inherent in biotech, a sector where breakthrough science can produce outsized returns but demands careful scrutiny.

Analyst’s Disclosure

I/we have no stock, option, or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, expressing my own opinions. I am not receiving compensation for it other than from Seeking Alpha. I have no business relationship with any company mentioned.

Seeking Alpha’s Disclosure

Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker, or US investment adviser or investment bank.

Our analysts are third-party authors, including professional and individual investors, who may not be licensed or certified by any institute or regulatory body.

Comments Recommended For You.