The XRP price prediction landscape presents a compelling case for a measured recovery over the coming weeks, despite current technical headwinds. Trading at $2.26 with a 1.77% daily decline, Ripple shows signs of oversold conditions that could trigger a bounce toward key resistance levels.

**XRP Price Prediction Summary**

Short-term targets for XRP remain above current price levels, indicating overhead resistance. Volume analysis shows $266 million in 24-hour trading, providing adequate liquidity for a sustained move. The daily Average True Range (ATR) of $0.17 suggests moderate volatility, allowing for measured price movements rather than explosive breaks.

—

### Ripple Price Targets: Bull and Bear Scenarios

**Bullish Case for XRP**

The primary XRP price target of $2.80 represents a 24% gain from current levels, achievable through breaking the immediate resistance at $2.70. This forecast relies on the Relative Strength Index (RSI) recovering above 50 and the MACD histogram turning positive.

Secondary targets include the 52-week high at $3.55, though reaching this point would require breaking strong resistance at $3.10. Institutional funding and the upcoming Ripple Prime launch provide fundamental catalysts supporting higher valuations.

**Bearish Risk for Ripple**

Downside protection exists at the immediate support of $2.07, representing an 8% decline risk. A break below this level could trigger a move toward strong support at $1.25 — the 52-week low area.

The key risk factors remain the negative MACD signal and price positioning below all major moving averages. Whether to buy or sell XRP largely depends on these support levels holding.

—

### Should You Buy XRP Now?

**Entry Strategy**

Current levels around $2.26 offer a reasonable entry point for those seeking exposure to XRP, with a tight stop-loss at $2.05 limiting downside risk to approximately 9%. The risk-reward profile favors buyers, with upside targets offering roughly 2:1 reward ratios.

For conservative investors, waiting for a break above $2.40 (20-day Simple Moving Average) would confirm bullish momentum before entering. Aggressive traders might accumulate on any dip toward the $2.07 support level.

Position sizing should remain modest given the mixed technical signals. A 2-3% portfolio allocation is appropriate for most investors.

—

### XRP Price Prediction Conclusion

This XRP price prediction maintains medium confidence in a recovery to $2.80 within the next two weeks, based on oversold technical conditions and positive institutional developments. The forecast suggests limited downside risk below $2.07, making current levels attractive for patient investors.

Key indicators to monitor include:

– RSI recovery above 45

– MACD histogram turning positive

– Volume confirmation on any breakout above $2.40

Failure to hold the $2.07 support level would invalidate the bullish scenario and trigger a reassessment toward lower targets.

The timeline for this prediction centers on the next 10-14 trading days, with the monthly outlook remaining constructive provided institutional momentum continues supporting XRP fundamentals.

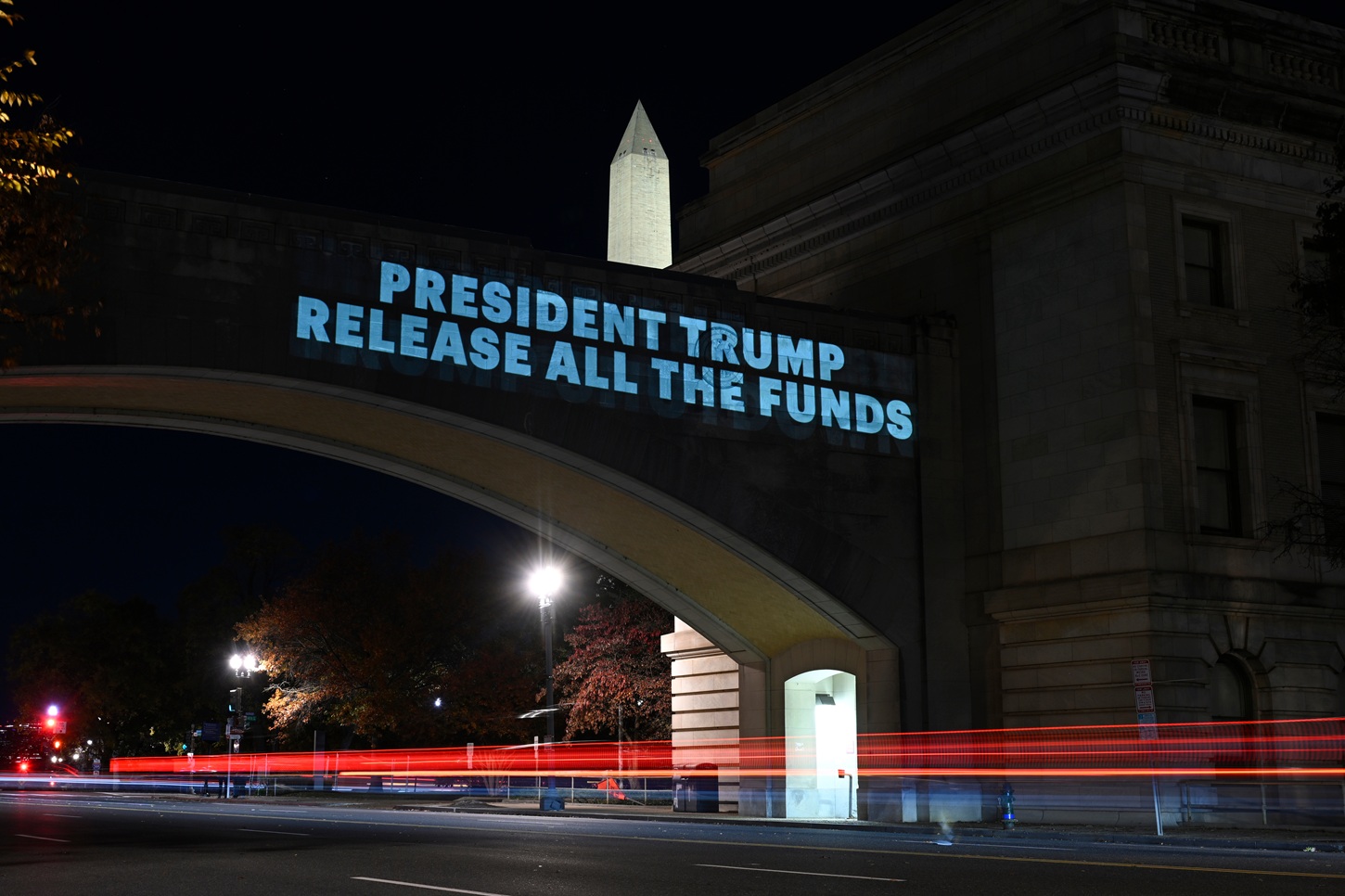

*Image source: Shutterstock.*

https://Blockchain.News/news/20251115-price-prediction-xrp-targeting-280-recovery-within-2-weeks