**Crypto Fear & Greed Index Improves to 37 Amid US-China Trade Deal Clarity**

Recent developments in US-China trade relations have brought a breath of fresh air to the cryptocurrency market, with the Crypto Fear & Greed Index climbing from 33 to 37. This improvement reflects a cautious but growing optimism among investors following the announcement of a trade deal suspension of tariffs until 2026.

—

### US-China Trade Deal Eases Market Tensions

US President Donald Trump’s announcement to suspend heightened reciprocal tariffs on Chinese imports until November 10, 2026, has provided much-needed stability to global markets. This clarity reduces fears of escalating trade conflicts, which have previously contributed to significant market volatility—including in the crypto sector.

The White House described the deal as “a massive victory that safeguards US economic strength and national security while putting American workers, farmers, and families first.” This could be a turning point for market sentiment, helping to ease concerns that have weighed heavily on cryptocurrencies.

—

### Impact of the Trade Deal on Crypto Market Sentiment

The ongoing trade uncertainties have historically correlated with trader anxiety and volatile price movements in digital assets. The recent tariff suspension follows a pattern seen earlier this year, when a 90-day suspension announced in April sparked a jump in the Crypto Fear & Greed Index from “Extreme Fear” (score of 18) to “Fear” (score of 39) within 24 hours.

This time, traders and analysts are hopeful the new multi-year suspension will similarly buoy the market, giving investors more confidence to enter or hold positions in cryptocurrencies like Bitcoin and Ethereum.

—

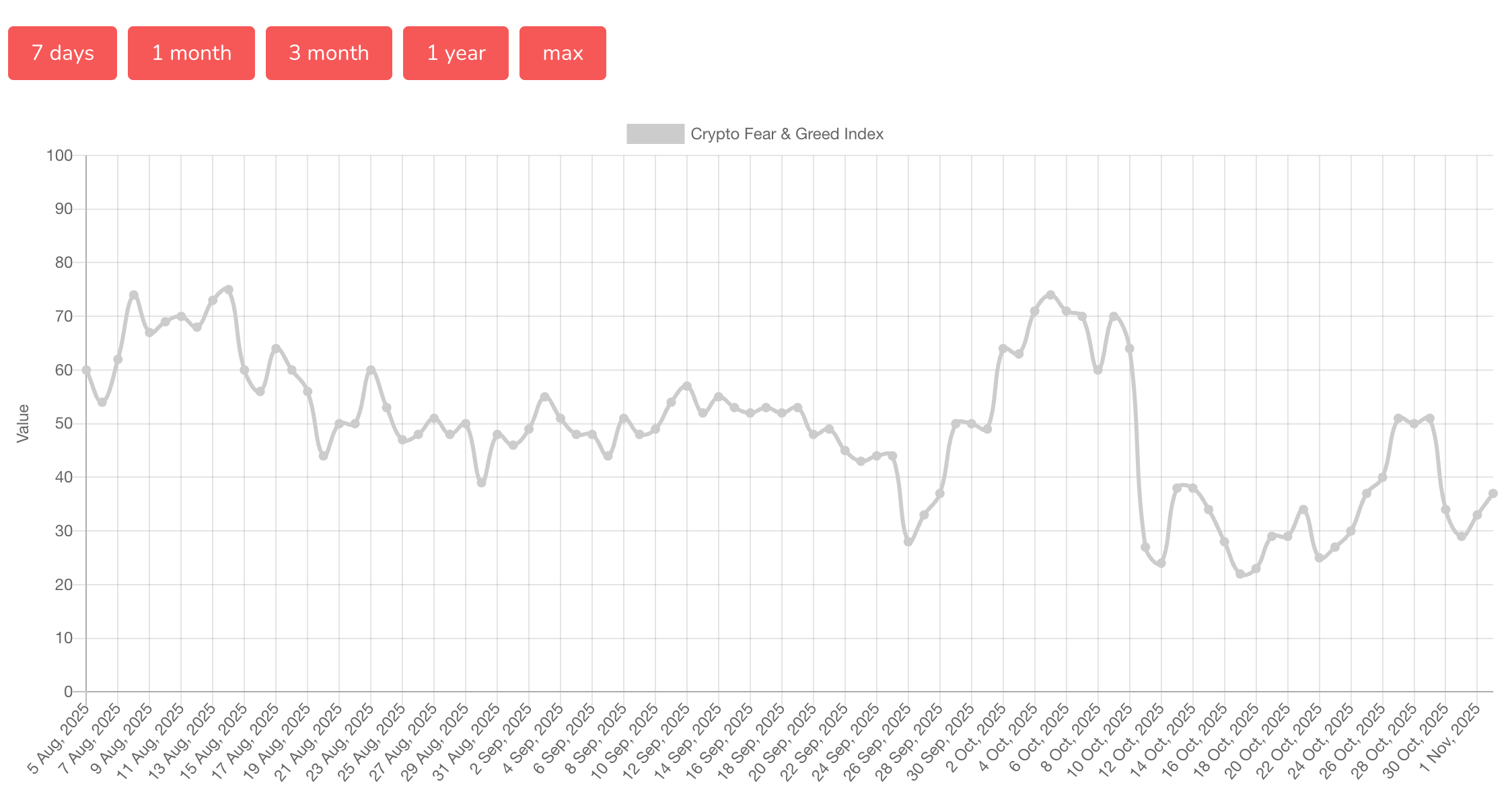

### Crypto Fear & Greed Index Responds to Trade News

On Sunday, the Crypto Fear & Greed Index—a key barometer of overall market sentiment—rose to 37 from 33 the previous day, maintaining its “Fear” classification but signaling a positive trend. The index has seen sharp fluctuations over the past few months amid trade tensions and market crashes.

Notably, the market suffered a severe dip on October 11, when over $19 billion worth of crypto assets were liquidated in 24 hours—partly attributed to President Trump’s earlier threat of 100% tariffs on China. Despite this, some experts view that crash as a potential “bottom” for the market.

—

### Analyst Perspectives: Is This the Start of a Bull Cycle?

Michael van de Poppe, founder of MN Trading Capital, commented on social media that October 11 could be looked back on as one of the “bottom days in hindsight.” He noted that the crypto market remains in the “early stage” of a bull cycle for Bitcoin and altcoins, suggesting that recent volatility may provide attractive entry points for investors.

Echoing this sentiment, crypto traders expressed optimism about the trade deal’s implications. Ash Crypto called the certainty “bullish for markets,” while 0xNobler labeled the news “GIGA BULLISH.”

—

### Market Performance and Outlook

Despite the positive headlines, the crypto market has yet to fully reflect the improved sentiment. Bitcoin (BTC) is currently trading around $110,354, up approximately 0.26% over the past 24 hours, while Ether (ETH) sits near $3,895, showing a 0.84% gain in the same period.

As the trade deal reduces one major source of uncertainty, market watchers anticipate that clearer trade relations will support renewed investor confidence and potentially more sustained price rallies in digital assets.

—

### Conclusion

The 2025 US-China trade deal marks a significant milestone in reducing global economic tensions, which is indirectly benefiting the cryptocurrency market. The incremental rise in the Crypto Fear & Greed Index, combined with analyst endorsements of a bullish outlook, suggests that renewed stability could trigger further gains for cryptocurrencies like Bitcoin and Ethereum.

While the market remains cautious, traders should keep a close eye on sentiment indicators as they navigate this evolving landscape. The resolution of trade uncertainties paves the way for a more favorable environment for digital asset investment and could signify the early phases of a prolonged bull run.

—

**Related Reading:**

– [Solana vs Ethereum ETFs: What Investors Need to Know]

– [Facebook’s Influence on Bitwise and the Crypto ETF Landscape]

Stay informed and monitor market sentiment to make the most of emerging opportunities in the crypto space.

https://bitcoinethereumnews.com/bitcoin/us-china-trade-deal-may-aid-bitcoin-recovery-as-fear-index-shows-slight-uptick/?utm_source=rss&utm_medium=rss&utm_campaign=us-china-trade-deal-may-aid-bitcoin-recovery-as-fear-index-shows-slight-uptick