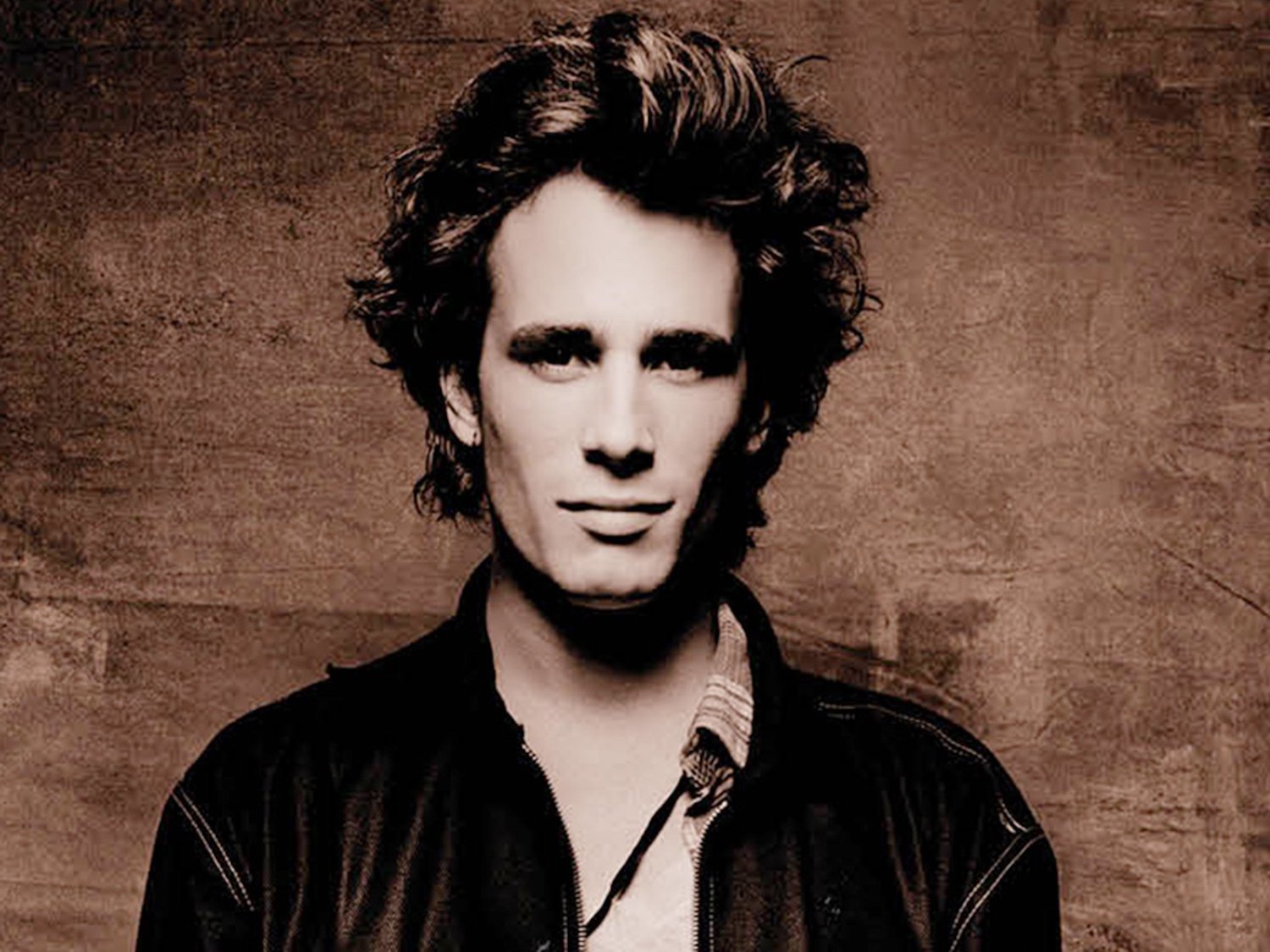

Happy Birthday, Jeff Buckley

Dream Brother.

Read Steve Kilbey (of The Church) in MAGNET on Jeff.

The post Happy Birthday Jeff Buckley appeared first on Magnet Magazine.

https://magnetmagazine.com/2025/11/17/happy-birthday-jeff-buckley/

Dream Brother.

Read Steve Kilbey (of The Church) in MAGNET on Jeff.

The post Happy Birthday Jeff Buckley appeared first on Magnet Magazine.

https://magnetmagazine.com/2025/11/17/happy-birthday-jeff-buckley/