Category: general

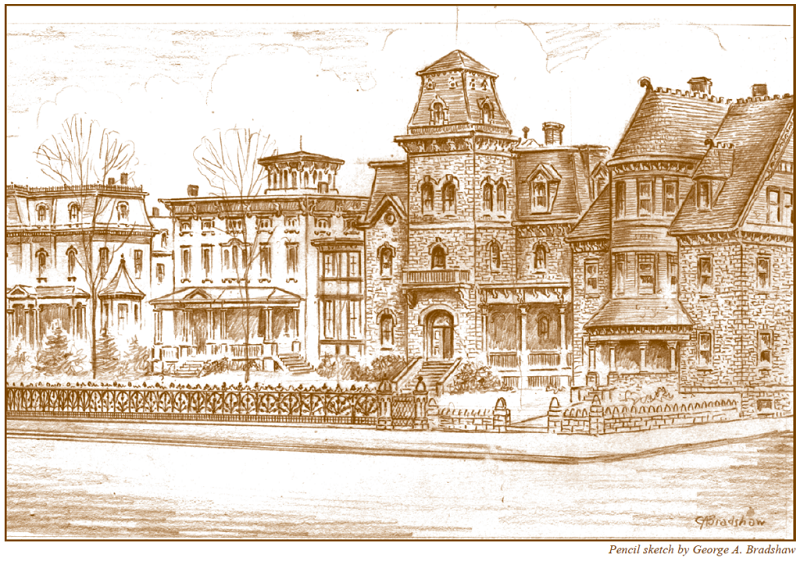

Trenton Historical Society Hosts Fundraiser at Bishop’s House Behind Trenton Transit Station

A MANSION PRESERVED: This house on the corner of Greenwood and South Clinton avenues in Trenton, likely familiar to those who travel in and out of Trenton Transit Center, is the site for the 20th annual “Stop the Wrecking Ball” on Saturday, November 22. (Pencil sketch by George A. Bradshaw) By Anne Levin The elegant [.].

CPP Fund Buys MSTR as Strategy Adds 8,178 BTC

The post CPP Fund Buys MSTR as Strategy Adds 8, 178 BTC appeared com. Canada’s biggest pension fund has moved into MicroStrategy just as Strategy adds more Bitcoin to its already massive stash. At the same time, a fresh weekly rebound on the chart hints that the stock’s slide may be starting to lose momentum. Canada CPP Fund Reveals New MicroStrategy Stake Canada’s largest pension manager has disclosed a new position in MicroStrategy, adding one of the biggest institutional entries into the Bitcoin-linked stock this quarter. The Canada Pension Plan Investment Board reported holding 393, 322 shares in its latest Form 13F filing with the U. S. Securities and Exchange Commission. The stake reflects the fund’s first recorded position in the company. The filing shows CPPIB’s shares were valued at about $127 million at the end of the third quarter. However, the position is worth roughly $80 million at recent market prices, as MicroStrategy moved lower along with the broader crypto-equity sector. The 13F report does not confirm when the shares were purchased, only that they were held as of the quarter’s close. Canada CPP Pension Fund MSTR Disclosure. MicroStrategy, which now operates as Strategy, remains the largest corporate Bitcoin holder and a key proxy for institutional BTC sentiment. Strategy Adds 8, 178 BTC as Holdings Rise to 649, 870 BTC Meanwhile, Strategy expanded its Bitcoin position after purchasing 8, 178 BTC for about $835. 6 million, according to the company’s latest disclosure. The buy took place at an average price of roughly $102,171 per coin, marking one of the firm’s larger accumulations this quarter. Strategy SEC Form 8K Filing. com The company also reported a 27. 8% BTC yield year-to-date, reflecting returns generated through its multi-layered Bitcoin-backed financing and yield programs. These.

NCIS: Origins season 2 episode 7 release date and time, what’s next, and everything you need to know

NCIS: Origins season 2 episode 7 is set to air on December 2, 2025, at 9 pm ET on CBS. This episode follows the journey of Leroy Jethro Gibbs in his early days with NCIS.

EUR/GBP holds positive ground above 0.8800 after UK CPI data

The post EUR/GBP holds positive ground above 0.8800 after UK CPI data appeared on BitcoinEthereumNews.com. The EUR/GBP cross gains ground to near 0.8815 during the early European session on Wednesday. The Pound Sterling (GBP) edges lower against the Euro (EUR) after the UK Consumer Price Index (CPI) inflation report. The final reading of the Harmonized Index of Consumer Prices (HICP) inflation report from the Eurozone will be published later on Wednesday. Data released by the United Kingdom’s Office for National Statistics on Wednesday showed that the country’s headline CPI rose 3.6% YoY in October, compared to an increase of 3.8% in September. This reading came in line with the market consensus. The Core CPI, which excludes the volatile prices of food and energy, climbed 3.4% YoY in October versus 3.5% prior, meeting the expectation of 3.4%. Meanwhile, the monthly UK CPI inflation increased to 0.4% in October from 0% in September. Markets projected a rise of 0.4%. The Pound Sterling attracts some sellers in an immediate reaction to the hotter UK CPI inflation data. Following a series of rate cuts in 2024 and early 2025, the ECB has kept interest rates unchanged as inflation has stabilized near the 2% target. ECB policymakers Gabriel Makhlouf and Olaf Sleijpen made remarks that supported expectations that the central bank would stay on hold. The cautious stance of the ECB provides some support to the EUR against the GBP. Markets priced in a 25% chance of a 25 basis points (bps) ECB rate cut by July next year, down from 45% early last week. Pound Sterling FAQs The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as…

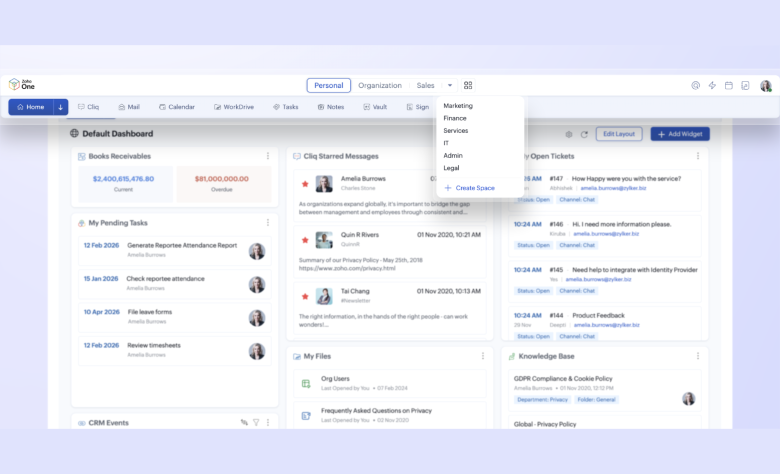

Zoho One adds an AI-ready UX that cuts across app boundaries

Zoho rolls out a new user experience for its Zoho One apps collection that unifies access to data, actions and AI capabilities, cutting across traditional app boundaries.

Double-digit salmon demand growth hard to see at current prices

A new report on the global farmed salmon market warns that unlocking continued demand growth will not be as simple as it has been and that the sector should follow a ‘battle-tested FMCG playbook’.

Glassnode’s Altcoin Vector Offers Insight into Crypto’s Volatile Frontier

The post Glassnode’s Altcoin Vector Offers Insight into Crypto’s Volatile Frontier appeared com. Zach Anderson Nov 18, 2025 09: 12 Glassnode’s Altcoin Vector #29 provides professional-grade insights into the altcoin market, identifying high-conviction setups and offering exclusive weekly reports for crypto enthusiasts. Introduction to Altcoin Vector Glassnode has released the latest edition of its Altcoin Vector series, offering a professional-grade analysis of the altcoin market landscape. The report, Altcoin Vector #29, delves into the volatile nature of the altcoin markets and aims to identify high-conviction setups for traders and investors. This exclusive weekly report is a significant resource for those interested in understanding the intricacies of the cryptocurrency sector, according to Glassnode. Comprehensive Market Analysis As the cryptocurrency market continues to evolve, the Altcoin Vector series seeks to provide clarity amidst the volatility. The report includes detailed analyses of the latest trends and movements within the altcoin markets, offering readers a deeper understanding of potential investment opportunities. By focusing on high-conviction setups, the report aims to equip traders with the knowledge needed to navigate these turbulent waters effectively. Subscription and Research Offerings Glassnode encourages readers to subscribe for free to access best-in-class market analysis on Bitcoin, Ethereum, and the broader DeFi landscape. The insights provided are supported by novel on-chain research, ensuring subscribers receive comprehensive and up-to-date information. By subscribing, users agree to Glassnode’s Terms and Conditions and Privacy Notice. Broader Context in the Crypto Space The release of Altcoin Vector #29 comes at a time when the cryptocurrency market is witnessing significant fluctuations. With regulatory changes and technological advancements shaping the future of digital currencies, resources like Glassnode’s report are invaluable for market participants. Such insights help traders anticipate market shifts and make informed decisions based on current data and trends. In conclusion, Glassnode’s Altcoin Vector #29 is a crucial tool for anyone looking to.

Quarterfinal nerves get to Lutheran Northwest in three-set loss to Valley Lutheran

Tuesday night was new territory for each member of the Rochester Hills Lutheran Northwest volleyball team.