US-China Trade Deal May Aid Bitcoin Recovery as Fear Index Shows Slight Uptick

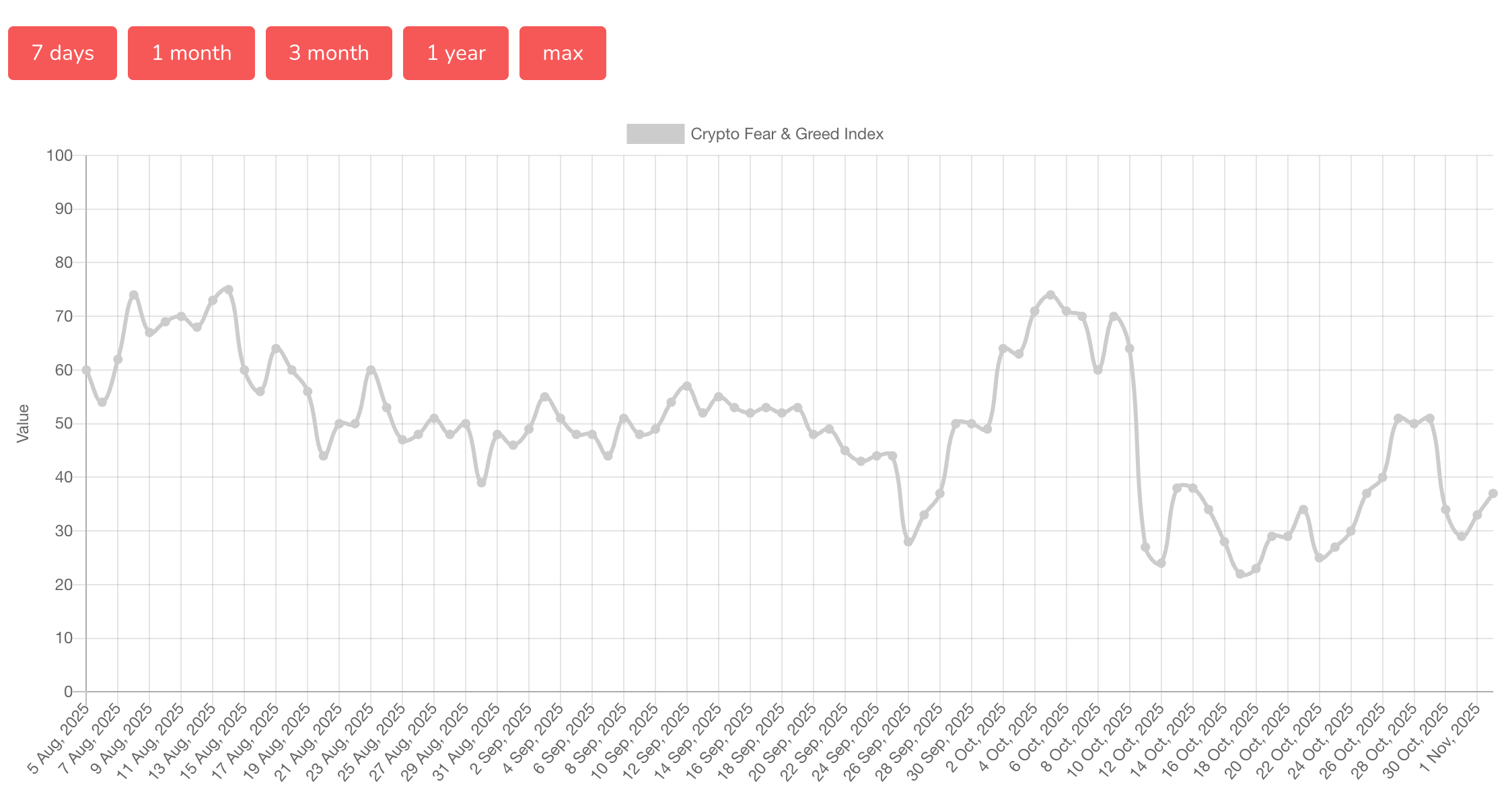

The post US-China Trade Deal May Aid Bitcocom. COINOTAG recommends • Exchange signup 💹 Trade with pro tools Fast execution, robust charts, clean risk controls. 👉 Open account → COINOTAG recommends • Exchange signup 🚀 Smooth orders, clear control Advanced order types and market depth in one view. 👉 Create account → COINOTAG recommends • Exchange signup 📈 Clarity in volatile markets Plan entries & exits, manage positions with discipline. 👉 Sign up → COINOTAG recommends • Exchange signup ⚡ Speed, depth, reliability Execute confidently when timing matters. 👉 Open account → COINOTAG recommends • Exchange signup 🧭 A focused workflow for traders Alerts, watchlists, and a repeatable process. 👉 Get started → COINOTAG recommends • Exchange signup ✅ Data‑driven decisions Focus on process-not noise. 👉 Sign up → The US-China trade deal announced in 2025 has sparked cautious optimism in the crypto market, with the Crypto Fear & Greed Index rising to 37 from 33, signaling a shift from extreme fear. Analysts predict this could mark the bottom of the recent crash, potentially boosting Bitcoin and altcoins in the ongoing bull cycle. Crypto Fear & Greed Index improves to 37 amid trade deal clarity. US President Donald Trump’s announcement suspends tariffs until 2026, easing market tensions. Recent crypto crash liquidated $19 billion; experts view October 11 as a potential bottom day with 18% fear score. Discover how the 2025 US-China trade deal influences crypto market sentiment. The Fear & Greed Index signals recovery potential for Bitcoin and Ethereum. Stay informed on bullish impacts-explore now! What is the impact of the US-China trade deal on crypto market sentiment? The US-China trade deal announced by President Donald Trump has introduced a measure of stability to global markets, indirectly benefiting the cryptocurrency sector by reducing fears of escalating tariffs. This agreement, which suspends heightened reciprocal tariffs on Chinese imports until.