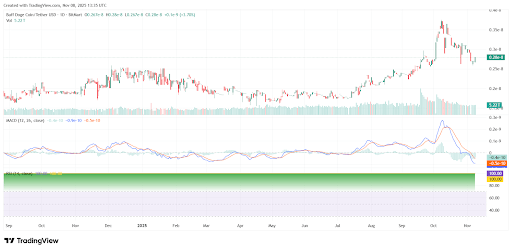

The post Binance Coin Price Rebounds From 900 Low Eyes Breakout Toward 1160 Zone appeared com. Binance Coin(BNB) trades near $1,000 after a strong rebound from $920, facing a key sell wall at $1,090. Analysts highlight growing accumulation, increased trading volume, and historical bullish patterns signaling renewed investor confidence. If buyers sustain momentum above $1,000, the asset could target the $1,160 resistance, reinforcing its medium-term bullish outlook. Resistance Builds Around $1,090 as Buyers Test Upper Levels Binance Coin is showing renewed momentum after rebounding from the $900 region. Analyst CW observed that the next major sell wall lies near $1,090, a level that has repeatedly halted previous rallies. According to CW’s analysis, its chart reflects multiple supply zones between $1,040 and $1,160, areas where sellers continue to exert pressure on the market. The consolidation near $1,000 signals that bulls are regaining control, though stronger volume is needed to sustain further upside movement. A decisive close above $1,090 could pave the way for a climb toward $1,160, a resistance zone that previously triggered sharp rejections in October. If momentum falls below $1,000, the lower support levels at $880 and $840 may reemerge. Seascape Network References Historical Patterns of Binance Recovery Seascape Network shared a light-hearted observation about its recurring timing with the token accumulation, humorously noting that the market tends to turn red whenever it adds the token to its portfolio. The reference pointed to two earlier periods, in 2019 and 2021, when similar declines occurred immediately after purchases but later evolved into long-term price growth phases. With the token currently trading near $967 at the time of Seascape’s post, the account questioned whether history might repeat. The.