**Bitcoin’s Descending Broadening Wedge Signals a Possible Bullish Breakout**

Bitcoin (BTC) is currently exhibiting a descending broadening wedge pattern that suggests a potential bullish breakout in the near term. Key support at $98,340 remains essential for preserving the short-term bullish structure. Analysts forecast an upside move toward the $115,000 mark, supported by consistent trading volumes and resilient price action within the formation.

—

### What Is Bitcoin’s Descending Broadening Wedge Pattern?

The descending broadening wedge is a technical pattern seen on the two-hour timeframe, defined by diverging trendlines with lower highs and higher lows. This formation often signals either a reversal or continuation of an uptrend.

Currently, Bitcoin trades near $102,024, having rebounded from lows around $97,000, demonstrating resilience within this pattern. Analysts, including Captain Faibik, believe that if the wedge structure holds, an upside breakout could drive BTC prices toward $115,000 in the coming week.

—

### BTC Price Structure and Short-Term Pattern Formation

Bitcoin’s price action within the descending broadening wedge shows a series of lower highs and lower lows, moving within a horizontal band between support at approximately $97,500 and resistance near $104,000.

The pattern remains active as BTC continues to consolidate steadily in this range. Price repeatedly tests the upper trendline but has yet to confirm a breakout. Trading volumes during this period have remained consistent, indicating a balanced participation between buyers and sellers.

The narrowing swing highs and lows reflect ongoing accumulation, typically a precursor to a directional move. Should the wedge structure prevail, analysts suggest Bitcoin may break out upwards soon, targeting a price around $115,000 — a level often considered a potential reversal point.

—

### Key Support Levels for Bitcoin

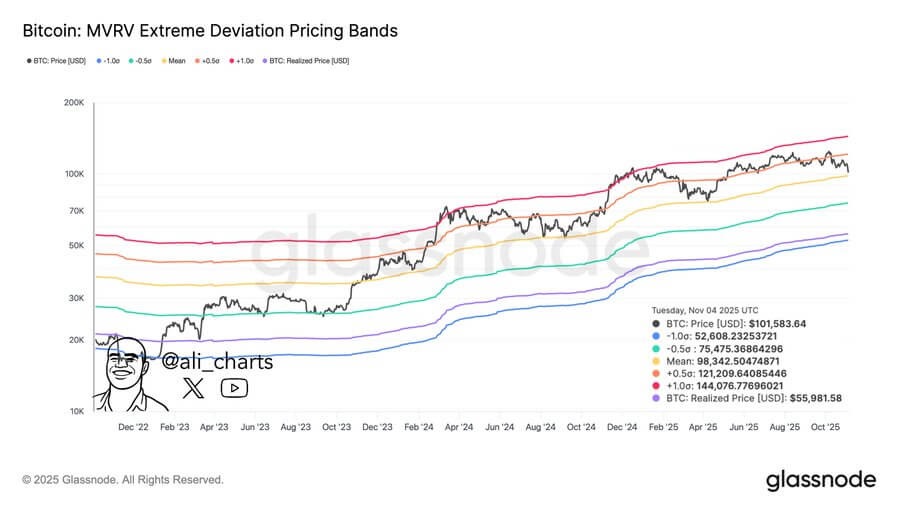

According to Ali Charts, there are three primary Bitcoin support levels to monitor:

– **$98,340** (primary short-term support)

– **$75,475** (secondary support)

– **$55,980** (longer-term support)

Holding above $98,340 is crucial to maintain Bitcoin’s short-term bullish structure and to avoid a deeper correction.

Currently, BTC consolidates below the descending resistance line with stable trading volumes, which further suggests accumulation in the market. A breakout above the upper trendline would likely confirm bullish momentum and potentially lead to further price gains.

—

### Market Outlook and Analyst Expectations

At the time of writing, Bitcoin trades near $102,024 within the descending broadening wedge. If momentum builds and the market environment remains stable, analysts anticipate a breakout toward the $115,000 territory within the next trading sessions.

Historical data supports this view, as similar wedge formations in past cycles have preceded rallies ranging from 10% to 20% over a short timeframe.

According to TradingView data, the wedge’s narrowing swing points indicate mounting pressure for a directional shift, which could bring increased volatility in the $100,000 to $115,000 range.

—

### Frequently Asked Questions

**Will Bitcoin Break Out to $115,000?**

Bitcoin could indeed break out toward $115,000 if it maintains support above $98,340 and gains momentum beyond the upper trendline. Analyst Captain Faibik notes that while historical patterns suggest a 10-15% rally from such setups, sustaining key support levels is vital to avoid downside risks.

**What Is the Short-Term Price Outlook for Bitcoin in 2025?**

The short-term outlook remains bullish as long as Bitcoin consolidates within the descending broadening wedge without breaching lower support levels. Experts like Ali Charts emphasize stability around $102,000, with the possibility of upward movement to $115,000 if trading volumes continue to reflect accumulation.

—

### Key Takeaways

– **Pattern Recognition:** Bitcoin’s descending broadening wedge on the 2-hour chart indicates a potential upward breakout with targets near $115,000.

– **Support Monitoring:** Critical support at $98,340 must hold to sustain the bullish structure, bolstered by stable trading volumes.

– **Market Action:** Signs of accumulation suggest an imminent upside move. Traders should watch for confirmation via a breakout above the wedge’s resistance.

—

### Conclusion

Bitcoin’s price action within the descending broadening wedge points to a promising short-term bullish setup. Maintaining key support at $98,340 and breaking above the upper trendline may trigger a significant move toward $115,000. Traders and investors should stay informed on these critical levels and market dynamics to make well-informed trading decisions.

Stay tuned for updates as the developing pattern unfolds and the cryptocurrency market evolves.

https://bitcoinethereumnews.com/bitcoin/bitcoin-consolidates-near-102k-in-wedge-pattern-eyeing-potential-115k-breakout/