Steve Miran said rising demand for dollar-pegged stablecoins could lower the U.S. neutral interest rate

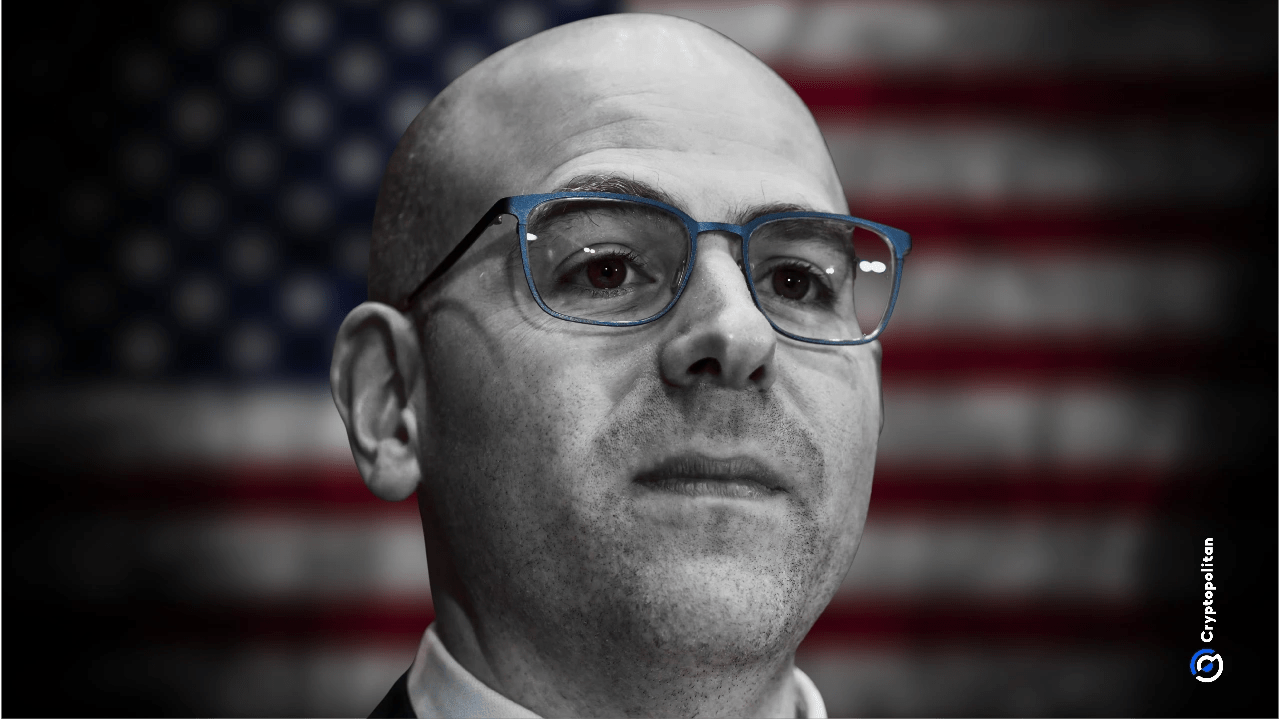

The post Steve Miran said rising demand for dollar-pegged stablecoins could lower the U. S. neutral interest rate appeared com. Trump-appointed Federal Reserve Governor Stephen Miran, known publicly in policy circles as Steve, told an audience of economists in New York on Friday that the fast-growing demand for stablecoins tied to the U. S. dollar may be pushing the U. S. neutral interest rate lower. According to reporting from Bloomberg, Steve said that a situation like that would likey require the Federal Reserve to adjust its own policy stance to avoid slowing the economy by mistake. Steve said the surge of stablecoins is drawing heavy demand toward U. S. Treasury bills and other highly liquid dollar instruments, especially from buyers outside the United States, which then adds to the supply of loanable money in the economy. When the supply of lendable funds increases, the neutral rate (the level of interest that supports steady growth without overheating or dragging activity) can drift downward. Steve said that if the neutral rate is plunging, then the Federal Reserve must respond by lowering its policy rate, otherwise it risks tightening conditions unintentionally. He described the situation plainly, saying “Stablecoins may become a multitrillion-dollar elephant in the room for central bankers.” He added that the buildup of stablecoins is already influencing markets and will keep doing so as adoption grows. Stablecoin growth pressures interest benchmarks Steve referred to existing research to say that expanding stablecoin usage could lower the Federal Reserve’s benchmark rate by around 0. 4 percentage point. That figure aligns with the pattern of his policy views during his tenure. Since joining the Fed, Steve has repeatedly argued for deeper and faster rate cuts, saying the commonly assumed neutral rate is too high. He has said that holding rates above the true neutral level risks slowing down the economy more than intended. Until now, Steve had based most of his arguments on inflation trends and conditions in.