Ford Shares Jump 12% Following Strong Earnings and Tariff Boosts

Ford shares soared 12% on Friday after the automaker reported robust earnings, with President Trump quick to credit his latest tariff adjustments for the strong results. After selling more pickups and SUVs than expected in the third quarter, Ford’s automotive revenue hit $47.19 billion, beating estimates of $43.08 billion.

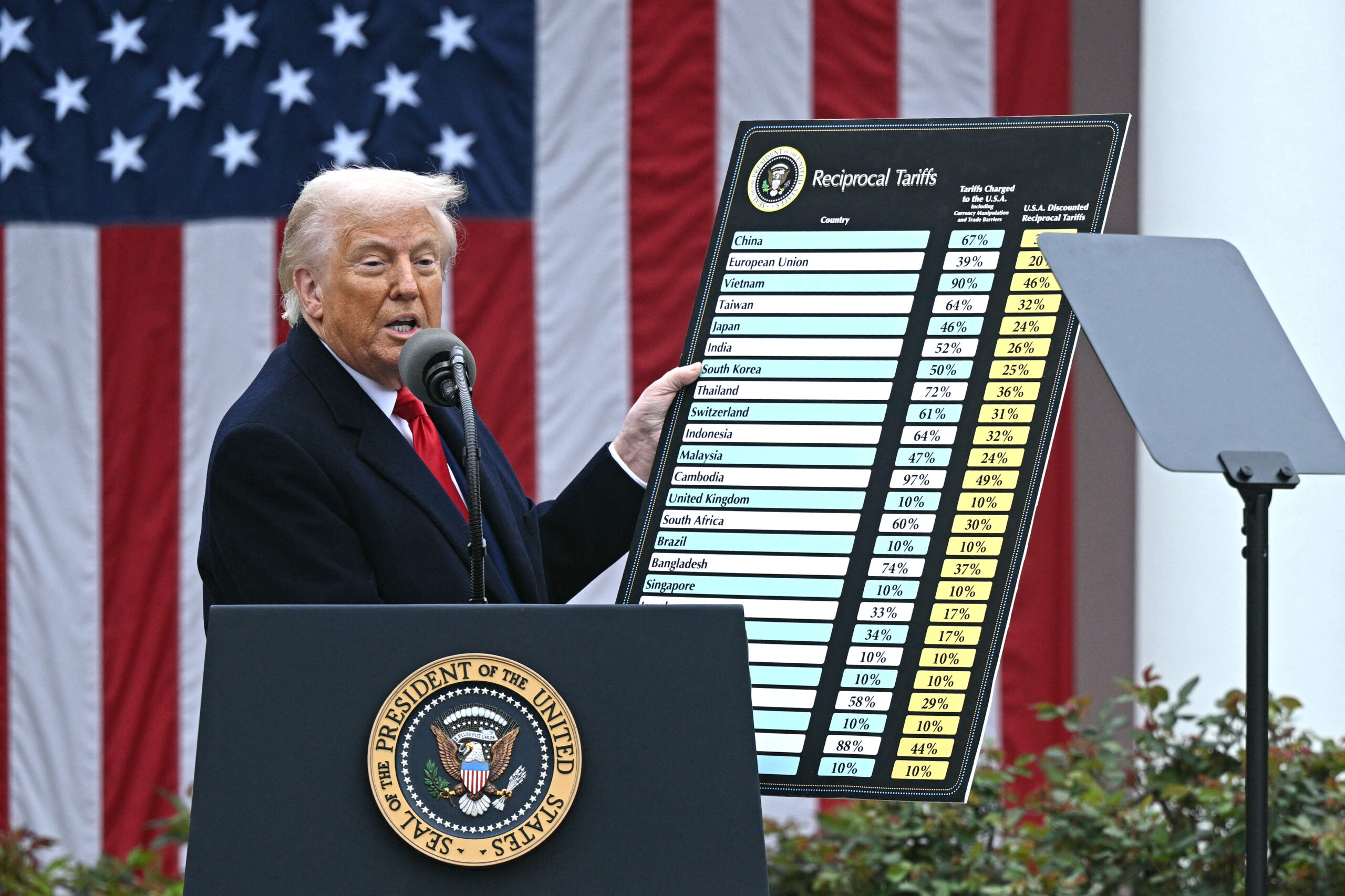

Trump took to social media to act as cheerleader-in-chief for Ford and General Motors, whose stock spiked more than 15% earlier this week, and to take a victory lap. “Ford and General Motors UP BIG on Tariffs placed on Big and Midsized Trucks coming from other countries. Thank you President Trump!” he wrote in a Friday morning post on Truth Social.

Recent Tariff Changes and Industry Response

President Trump recently extended exemptions for U.S. firms using imported auto parts and announced plans to impose fresh tariffs on foreign heavy-duty trucks to make American alternatives more competitive. Top executives at Ford and GM praised the president this week as they slashed anticipated tariff costs.

“I’d like to thank President Trump and his team,” Ford CEO Jim Farley said during a call with analysts. Ford reduced its expected tariff costs by $1 billion, now estimating them at about $2 billion.

Mary Barra, Chief Executive of GM, also expressed gratitude earlier this week for “the important tariff updates.” General Motors cut its projected tariff impact by half a billion dollars, lowering estimates to between $3.5 billion and $4.5 billion.

Strong Quarterly Performance Amid Challenges

On Thursday, Ford reported adjusted earnings per share (EPS) of 45 cents, surpassing expectations of 36 cents. “Our performance in the quarter shows that the Ford+ plan is delivering consistent improvement,” said Sherry House, Ford’s Chief Financial Officer, referring to the company’s turnaround strategy. “Our underlying business becomes stronger, more efficient, more agile, and increasingly durable.”

However, Ford was forced to cut its annual forecasts for the year due to a devastating fire at a New York aluminum plant operated by Novelis, a major supplier to several U.S. automakers. This incident is expected to slow production of heavy trucks and large SUVs—some of Ford’s top-selling and most profitable vehicles.

The fire is projected to cost Ford between $1.5 billion and $2 billion, though the company hopes to mitigate the damage by ramping up manufacturing of the affected vehicles once supplies become available. This effort includes plans to add 1,000 workers next year to its facilities in Michigan and Kentucky.

Revised Forecasts for 2025

Ford’s updated forecast for 2025 includes adjusted earnings before interest and taxes (EBIT) of $6 billion to $6.5 billion, down from the previous range of $6.5 billion to $7.5 billion. Had the fire not occurred, Ford was planning to raise its annual forecast to more than $8 billion in adjusted EBIT, CFO Sherry House stated.

General Motors’ Earnings Surge and Outlook

General Motors experienced a notable stock surge on Tuesday—the automaker’s best single-day performance since 2020 and its second-best since emerging from bankruptcy in 2009. GM reported adjusted EPS of $2.80, beating expectations of $2.31, with revenue reaching $48.59 billion against estimates of $45.27 billion.

“Thanks to the collective efforts of our team and our compelling vehicle portfolio, GM delivered another very good quarter of earnings and free cash flow,” Barra said in a letter to shareholders. “Based on our performance, we are raising our full-year guidance, underscoring our confidence in the company’s trajectory.”

GM now expects adjusted EBIT of $12 billion to $13 billion, up from $10 billion to $12.5 billion.

Layoffs and Other Challenges

Despite positive earnings, GM laid off more than 200 salaried employees on Friday, primarily affecting Computer-Aided Design (CAD) engineers at the company’s tech campus in Detroit.

Additionally, the company’s adjusted results do not factor in $1.6 billion in losses related to planned changes in its electric vehicle rollout. These changes followed the end of a federal tax credit and a slump in demand.

Third Quarter Net Income and Market Performance

GM’s net income attributable to stockholders was $1.3 billion in the third quarter, down 57% from approximately $3.1 billion a year earlier. Its net income margin dropped to 2.7%, compared to 6.3% in the same quarter last year.

The North American business, which typically delivers the firm’s most substantial profits, showed signs of struggle. The segment earned more than $2.5 billion in the third quarter, but its adjusted profit margin plunged 9.7% year-over-year to 6.2%.

GM’s operations in China helped offset the lower North American earnings. Barra emphasized that the automaker’s “top priority” is to return to 8% to 10% adjusted profit margins in the North American market.

—

Both Ford and GM showcased strong quarterly performance, buoyed by tariff adjustments and solid vehicle sales, despite facing significant operational challenges. The outlook for both automakers remains cautiously optimistic as they navigate supply chain disruptions and shifting market dynamics.

https://nypost.com/2025/10/24/business/trump-touts-tariff-tweaks-as-ford-general-motors-deliver-strong-earnings/