**Yieldfund Opens Access to Institutional-Grade Quantitative Trading Strategies**

Yieldfund, a Dutch quantitative trading firm, is breaking new ground by offering access to institutional-grade trading strategies once reserved exclusively for Wall Street giants. For years, quantitative trading has been the domain of large institutional investors and financial powerhouses equipped with advanced technologies and deep expertise. These sophisticated systems can execute thousands of trades within milliseconds, optimizing capital growth while minimizing risk—if structured correctly.

—

### The Traditional Barriers to Quantitative Trading

Until now, these powerful trading methods remained largely inaccessible to the average investor. The reasons were clear: complexity, significant capital requirements, and a steep learning curve. Many retail investors were left relying on rudimentary tactics such as “opening a position and hoping for the best,” which often proved ineffective.

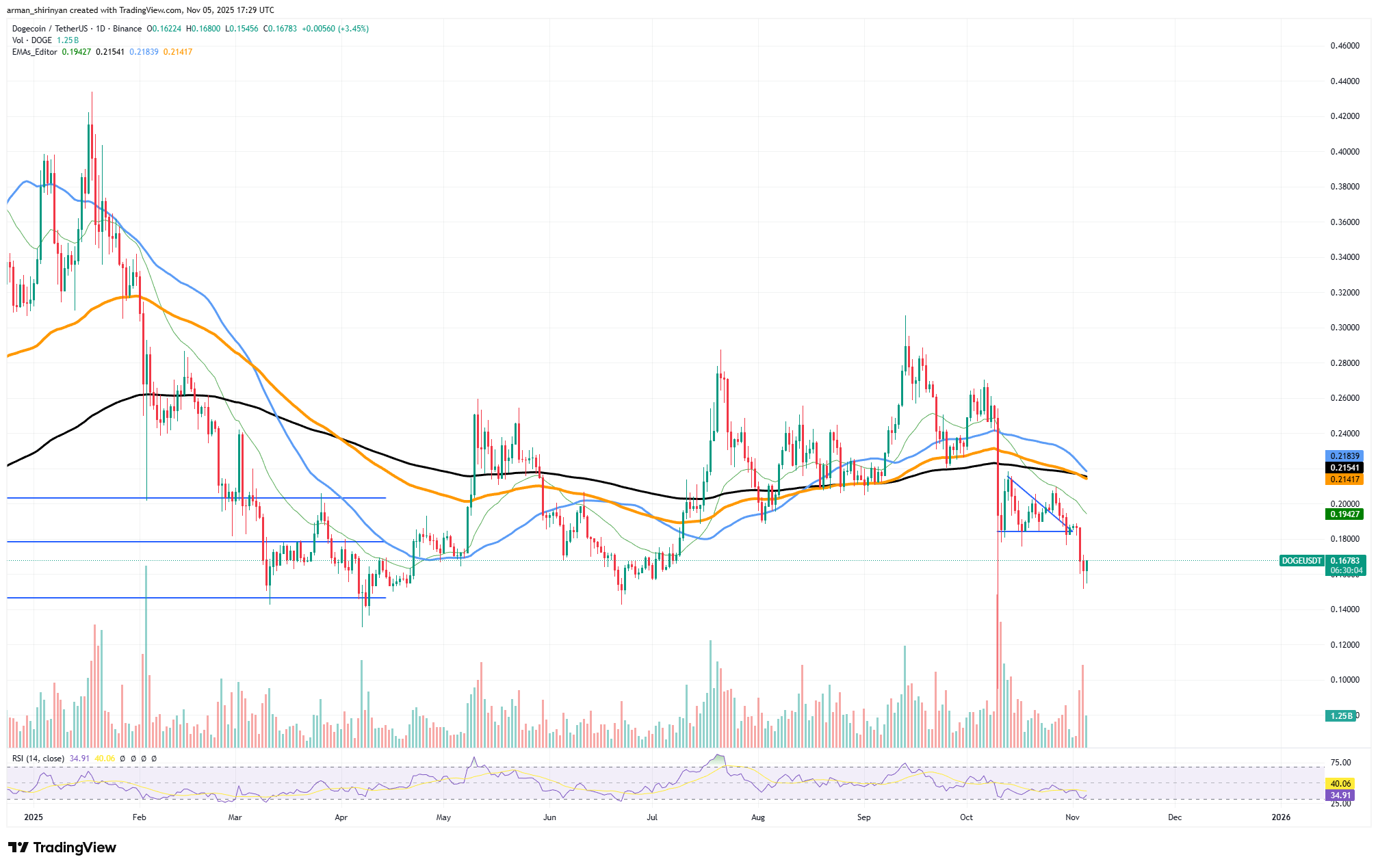

The crypto market, while ripe with opportunity, embodies this paradox. It promises high returns but demands extensive market knowledge, emotional resilience, and considerable time investment. Institutional players, by contrast, have long employed data-driven, automated trading systems to remove guesswork, capitalize on inefficiencies, and react to market movements within seconds.

This created a two-tiered system: institutional investors leveraged advanced strategies and profited, while retail traders faced outdated information, limited resources, and higher failure rates—statistics show 90% of retail traders lose money within their first year.

—

### Democratizing Quantitative Trading with Yieldfund

Yieldfund is changing the landscape by lowering the barriers to entry for quantitative trading strategies. The company offers a simple investment model built on bond-based structures, meaning investors can gain crypto market exposure without trading themselves.

A $10,000 minimum investment serves as a calculated entry point, accessible to serious retail investors while ensuring the necessary capital to generate attractive yields. The entire process is designed to be straightforward, featuring:

– Pre-packaged investment plans

– Self-onboarding capabilities

– Active support from investor relations managers

– A comprehensive investor dashboard

Opening an account and allocating capital like an institutional investor has never been easier. Investors can set up accounts independently and communicate directly with support managers to discuss goals or questions.

—

### Transparency and Investor Confidence

Yieldfund emphasizes transparency and ongoing communication to build investor trust. Users can monitor returns, payouts, and even closed orders in real time, regardless of their chosen investment plan.

A dedicated support team is available five days a week to address investor inquiries. The investor dashboard consolidates all pertinent information—payout details, wallet addresses, contract terms, and investment plans—into a single, accessible platform.

This level of openness was previously unavailable to retail investors, setting Yieldfund apart in an industry where minimal transparency is the norm.

—

### Proven, Measurable Performance

Quantitative and algorithmic trading strategies offer clear advantages: better performance during volatility, faster trade execution, and disciplined risk management adhering to preset rules.

Yieldfund’s track record underscores the benefits of making these strategies accessible. In 2024, the company achieved a 93% success rate on individual trades. Monthly returns in 2025 have averaged 11%, while the total annual profit for 2024 reached an impressive 148%.

These results significantly outperform major market indices such as the S&P 500, Bitcoin holdings, and the AEX.

Traditional investors rely on manual trades using lagging indicators, whereas Yieldfund’s automated system analyzes trade volume, volatility, and market capitalization to identify opportunities within fractions of a second. Focusing on the Top 10 cryptocurrencies also helps reduce the risks linked to less liquid assets, prioritizing speed and precision—attributes beyond human capabilities.

—

### Yieldfund: Institutional Strategies for Every Investor

Quantitative trading strategies are no longer exclusive to high-net-worth individuals. Yieldfund bridges this gap by offering an intuitive, accessible platform tailored for everyday investors.

Headquartered in the Netherlands, Yieldfund is registered with the Dutch Authority for Financial Markets (AFM) and operates under a bond structure that contractually guarantees weekly payouts. Demonstrating its commitment to accountability, the company plans to audit its trading results and payouts by early Q2 2026.

—

### A Simple, Transparent Path to Crypto Market Growth

Yieldfund’s mission centers on addressing the key obstacles that deter most retail investors: the complexity and unpredictability of manual trading. By simplifying access to institutional-grade quantitative strategies through a transparent investment structure, the company enables everyday investors to benefit from cryptocurrency market growth—without needing specialized knowledge or constant market monitoring.

Whether you are a trader looking to explore quantitative strategies without active trading or an experienced investor seeking portfolio diversification, Yieldfund offers an effective, consistent, and accessible solution to navigating the crypto market.

—

**Discover how Yieldfund is redefining crypto investing, empowering retail investors to access the same proven strategies used by Wall Street’s best.**

https://crypto.news/why-yieldfund-is-opening-quant-strategies-to-everyday-investors/