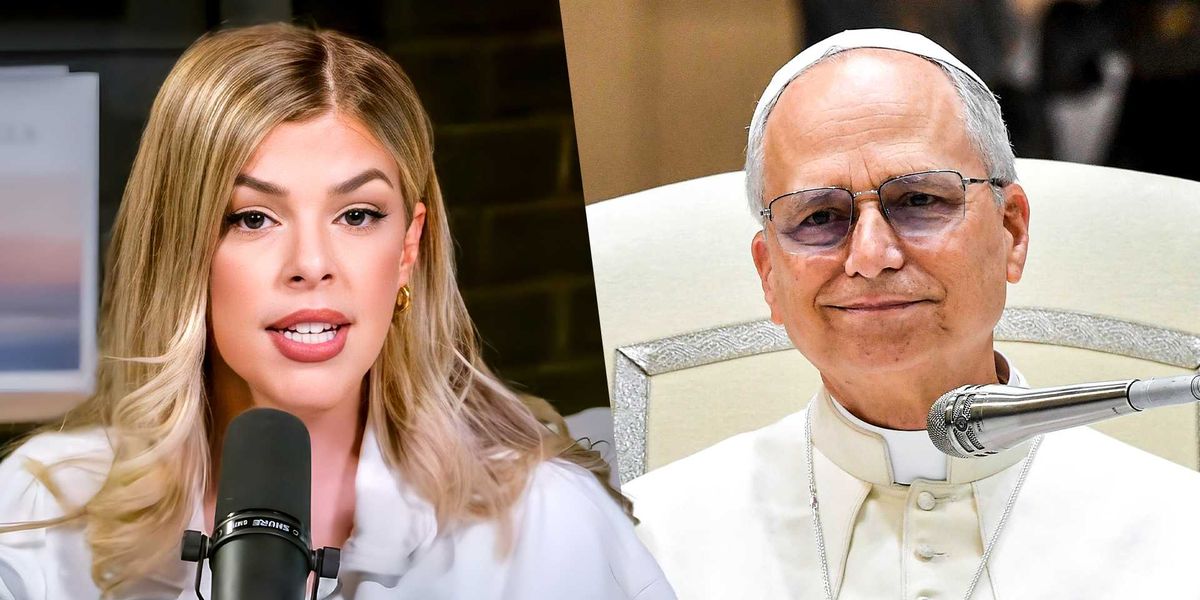

Pope Leo’s recent remarks linking abortion and the death penalty have reignited the age-old debate over whether someone can truly be “pro-life” while supporting capital punishment but BlazeTV host Allie Beth Stuckey says the answer is an unequivocal yes.“When he’s talking about the death penalty not being pro-life, then what he is essentially saying is that God is not pro-life because God is the one that commands the death penalty,” Stuckey says.“God says in Genesis 9, ‘Whoever sheds the blood of man by man shall his blood be shed. For God made man in his own image,’” she explains.“The answer to, ‘Does it still apply today? Because is it still true today?’ is yes,” Stuckey says. “God still makes us in his image. We are still made in God’s image. So we read right there that the reason for the death penalty for murder is because of the value of human beings, and the value of human beings as image-bearers of God has not changed.”“Then that means that that is still a good punishment for murder. That doesn’t mean that it has to always be the punishment for murder,” she continues. Throughout scripture, Stuckey points out that “God gives mercy to certain people,” but it doesn’t “negate the command.”“God actually gives the death penalty for a variety of crimes in ancient Israel. But we as Christians don’t have to abide by all of the ceremonial and cleansing laws of ancient Israel because Jesus has become our cleansing. He has become our sacrifice,” she explains. And it’s not just in Genesis 9 where this same principle is reflected, but also in the New Testament.“In Romans 13, we read that the government is instituted by God to bear the sword against the evildoer. That’s not just an analogy. That is a symbol of execution. That is a God-ordained government directive to restrain evil.”While some make the argument that one of the Ten Commandments is “thou shall not kill,” Stuckey explains that it’s actually “thou shall not murder.”“Murder and killing aren’t the same thing. If you are killing someone in self-defense, that’s not murder. If it is a just war and you are killing someone, that is not murder,” she says.“So I am actually pro-life for the same reason that I am pro-death-penalty, because I care about innocent life. Because human beings are so important and so valuable that the crime of killing one of us is so hefty that the only commensurate punishment for it is execution,” she adds. Want.