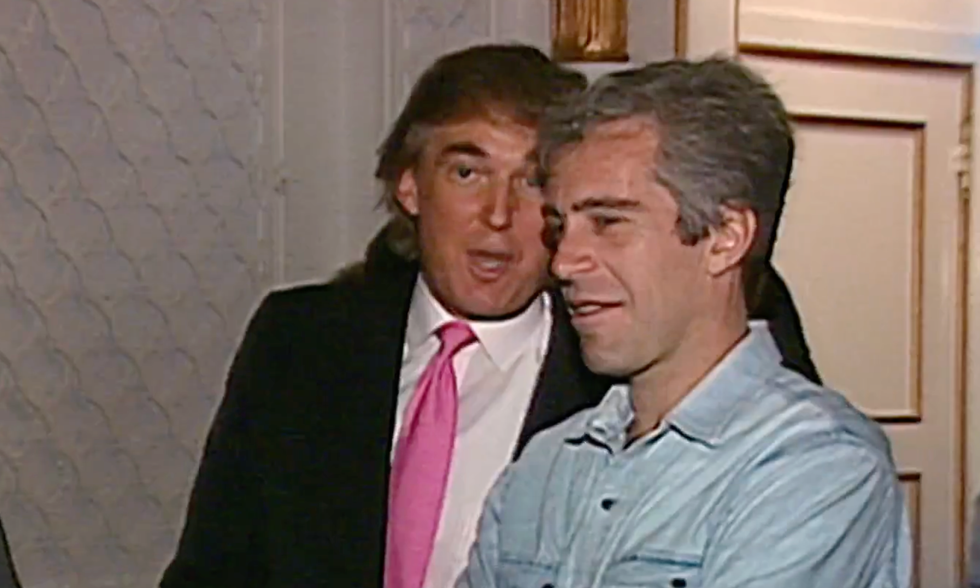

Columnist and author Ross Douthat tells the New York Times that while the new Epstein documents are successfully riling up America and the White House, there’s plenty they don’t yet answer.“The new tranche of information confirms, yet again, the moral squalor of various powerful Americans. But it still leaves us short of definitive answers to the outstanding Epstein questions: Did other powerful men have sex with the underage girls that he trafficked? What were his connections, if any, to the world of intelligence? And what unrevealed details have made Trump so intent on preventing further disclosure?”Douthat referenced Epstein’s email to Ghislaine Maxwell shortly after his release from prison: “I want you to realize that the dog that hasn’t barked is Trump .[VICTIM] spent hours at my house with him, he has never once been mentioned. Police chief, etc. I’m 75 percent there.”That letter, by itself, said Douthat, “is not the smoking gun proving Trump’s complicity in sex crimes.”Other letters, he said, suggest “it was normal for Epstein’s friends to have sexual encounters if not sexual intercourse” and that “Epstein at least wanted people to think the girls in involved were not minors.” Third, they prove Epstein “had a longstanding grudge against Trump but probably did not have some secret tape of Trump getting a massage or more.”“But then the great question remains: Why doesn’t Trump want more disclosure?” asked Douthat, referencing Trump’s campaign to keep the documents hidden from the House Oversight Committee.“It’s possible that he just doesn’t like the embarrassment of having everyone reminded that he was one of the rich creeps in the Epstein circle. Or it’s possible that there’s something truly sensitive related to Epstein and intelligence that has yet to be revealed,” said Douthat.“Or it’s possible that there is some thread remaining here, and not necessarily the obvious one, that the president really, really doesn’t want to see get pulled,” he said. Read the New York Times report at this link.